Reverse Repos: Too Much Liquidity In The System

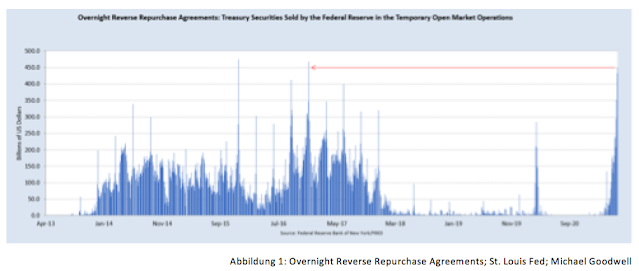

It has been a calm week on financial markets more or less, equity and bond markets rose slightly and commodity prices corrected a bit, apart from energy, where prices continued to pick up. However, I was more interested into another topic this week, a topic I mentioned briefly in previous texts, namely the US repo market. Since the beginning of May the number of overnight reverse repose with the Fed rose at an 8 % rate and on Wednesday reverse repos with the Fed reached November 2016 highs ( on Thursday they reached an all-time high ). Why is this happening & what are the conclusions on that? In this commentary I try to find answers. Firstly, I want you to think back to September of 2019: Back then, the opposite of what is happening today took place. There was lack of liquidity and the Federal Reserve had to pump hundreds of billions into the financial system to keep rates down at the short end of the curve. Banks and other financial actors needed cash and therefore engaged on...