This Time Is Really Different

This week I want to write about three topics which caught my attention since last Friday. Firstly, there was the really, really bad jobs-report from Friday. Secondly, Christian Broda and Stanley Druckenmiller have published a commentary in the Wall Street Journal, stating that the Fed is playing with fire and thirdly, big inflation numbers from this Wednesday.

The US Jobs Report

Expectations have been high last Friday: Economists expected very good job numbers because of the tail wind from the grand reopening and that people are returning to normal life. Consensus estimated 1 million additional jobs, Aneta Markowska from Jeffries even estimated 2.1 million jobs.

In the end, the US economy added 266 thousand jobs in April, Markowska has roughly miscalculated by a factor of TEN. Instead of an unemployment rate of 5.8 %, unemployment still stayed above the 6 % level (officially).

The labor force has grown by 430,000 in April, with 102,000 looking for work and 328,000 with an actual job. The unemployment gap to fill is still 4 million above pre-pandemic levels (5,117 million vs 9,812 million)

10y treasury yields tanked on the news and tanked by more than 10 bps until they recovered later that day.

Everyone who talked about a red-hot economy (Buffet) with reference to quarterly earnings, was wrong.

Mohamed El-Erian tried to work out why this happened in a recent Bloomberg Opinion piece: According to him, could be due to three broad factors: A deficiency of effective demand for labor; a problem in fitting available labor supply to demand; and data issues. The situation may get worse, because a less-responsive labor market would hold back an inclusive recovery and increase inflationary pressures.

However, markets have recovered shortly after, because on the one hand bad news are good news these days (because market participants expect maybe more stimulus to come) and, on the other had, central bankers and politicians came out immediately to calm down everyone. So everyone is waiting for the next job report...

I am still curious, on what basis the Biden administration thinks that the US can recover all jobs which were lost during the pandemic within one year. While people have hard times to return into the labor force, businesses find it hard to fill open jobs (and I have wrote a little bit here recently).

Further, the world has changed, as the Washington Post writes: There is also growing evidence — both anecdotal and in surveys — that a lot of people want to do something different with their lives than they did before the pandemic. The coronavirus outbreak has had a dramatic psychological effect on workers, and people are reassessing what they want to do and how they want to work, whether in an office, at home or some hybrid combination.

It seems that many people, who worked within sectors that were hit hard by government imposed lockdowns, think about looking for jobs in other branches. The problem is that they (still) lack skills in those jobs. Maybe we are on the brink of a more structural change...

The Fed Is Playing With Fire

Loose monetary policy by the Fed is causing fears that they may be too loose fore to long. In a recent Wall Street Journal commentary Christian Broda and Stan Druckenmiller write about that.

They fear that the Fed may keep its' emergency programs in place for too long and therefore this may a bigger risk than missing inflation goals.

They write: The American economy is back to prerecession levels of gross domestic product and the unemployment rate has recovered 70% of the initial pandemic hit in only six months, four times as fast as in a typical recession. Normally at this stage of a recovery, the Fed would be planning its first rate hike. This time the Fed is telling markets that the first hike will happen in 32 months, 2½ years later than normal.

As you can see in the chart above, the recovery on the labor market has happened in record times, although we know that this crisis is much different from other crises because the Fed's monetary policy has never been that expansionary as during the coronavirus pandemic.

Broda and Druckenmiller refer to the fact that the recovery is already in full swing and the fiscal excess is already visible in many places: Consumers are spending like never before, construction is booming, and labor shortages are ubiquitous, thanks to direct government transfers.

Now, progressive politicians finally do all the projects that they wanted to do for years. Interestingly, as the commentary notes, two-thirds of all relief-checks were sent out after the vaccine was proven effective and the recovery was accelerating.

Both are correct when they say that the Fed is manipulating the most important price in a market economy for quite a while now, namely long-term interest rates. I agree that this behavior is risky, for both the economy at large and the Fed itself.

According to the article, the Congessional Budget Office says that in 20 years almost 30% of all yearly fiscal revenues will have to be used solely to pay back interests on government debt, up from a current level of 8%. Broda and Druckenmiller claim (and I agree) that there is no doubt that the Fed will have to monetize at least a part of all that debt.

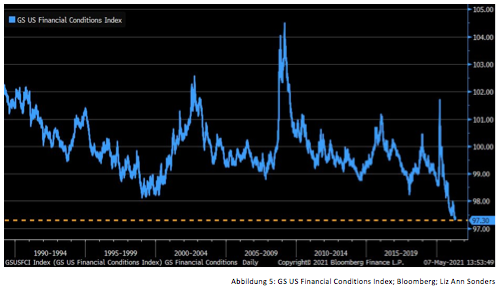

If you look at current financial conditions, you will notice how crazy the current times are because in times of record debt, financial conditions are at all-time lows.

It seems that markets are extremely vulnerable, not only equity markets, but crypto-markets and the recent rise in special-purpose acquisition companies (SPACs) are also in a mania. Broda and Druckenmiller suggest that the Fed should not fuel asset prices, but balance them. The danger of a deflationary shock, starting from asset markets, is immanent, they say.

I believe that the Fed can chose between two scenarios: Either the Fed can try to save the economy or to save the dollar. I doubt that both is possible as the Fed is trapped, although I would say this is a longterm scenario because I expect the dollar to gain strength short term against other fiat currencies like the Euro, the Yen or others.

US Inflation

Everyone was excited to get April-inflation numbers for the US. Consensus has expected an increase of 0.2 % moth-over-month, or 3.6 % year-over-year. As I wrote about inflation several times on this blog, my guess was that inflation will surprise after it has been in line in March.

As for April, my guess was correct. YoY CPI was at 4.2 %, 0.6 percentage points higher than expected, MoM also 0.6 percentage points higher, at 0.8 %. It has been the biggest increase in the CPI since 2008 (YoY).

If you look at MoM core CPI, the picture gets more disturbing: Monthly core inflation was 0.9%, 0.6 percentage points higher than expected. The last time inflation was that high was back in 1981(!).

Used-car prices rose 10 % MoM, the largest one month increase since the series began in 1953. Here are those sectors with price increases...

Conclusion

What is my take-away of all this, how is all this playing out further? My opinion is that the rise in inflation and growth will continue, just as it did recently.

However, weak labor market data shows that the narrative may change sometime in Q3 when economic growth is stalling because of big market interferences by the Fed and the US government (stimmy-checks).

The data may lead to the conclusion that we may observe a labor supply shortage in service-sector industries, which were hit hard by the pandemic, because workers want to find jobs in other sectors of the economy. I would consider this as a cause, why businesses struggle to find workers and the Biden stimulus-checks are fueling this labor shortage further. The question is, if small businesses can even afford to raise wages (because of low profit-margins). If those companies go out of business, this decrease in supply will, ceteris paribus, lead to more inflationary pressures.

The Fed is becoming a blind passenger within this system, but I am more pessimistic than Broda and Druckenmiller: I do not think that the Fed can come out of all this mess without any damage. I cannot think of any scenario where this is possible.

If growth is stalling but inflation is accelerating, we would get into a stagflationary scenario, where prices and unemployment continues to rise. This is my most probable scenario for now...

Nevertheless, have a great weekend everyone!

Fabian Wintersberger

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity.

Play Emperor Casino | Shootercasino

ReplyDeletePlay Emperor 1xbet Casino | Play the best online casino slot games for real 제왕 카지노 money at kadangpintar Shootercasino. High-quality graphics and a high-quality sound stage, Emperor Casino have you