Reverse Repos: Too Much Liquidity In The System

It has been a calm week on financial markets more or less, equity and bond markets rose slightly and commodity prices corrected a bit, apart from energy, where prices continued to pick up.

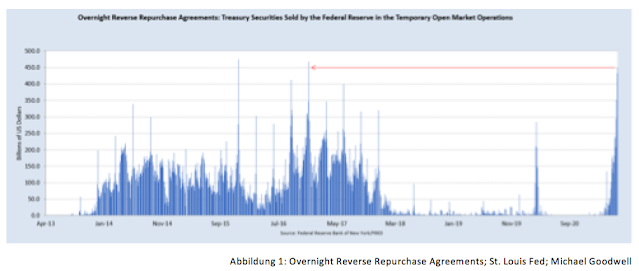

However, I was more interested into another topic this week, a topic I mentioned briefly in previous texts, namely the US repo market. Since the beginning of May the number of overnight reverse repose with the Fed rose at an 8 % rate and on Wednesday reverse repos with the Fed reached November 2016 highs (on Thursday they reached an all-time high).

Why is this happening & what are the conclusions on that? In this commentary I try to find answers.

Firstly, I want you to think back to September of 2019: Back then, the opposite of what is happening today took place. There was lack of liquidity and the Federal Reserve had to pump hundreds of billions into the financial system to keep rates down at the short end of the curve.

Banks and other financial actors needed cash and therefore engaged on the overnight repo market. Let us say that Bank A needs cash and borrows it from Bank B. As collateral they transfer a 10y treasury bond to Bank B (Bank B has too much liquidity as it needs). For overnight repos, the next day, Bank A transfers the cash plus interest back to Bank B and Bank B transfers the collateral back to Bank A.

The Problem in 2019 was that there were no banks who wanted to give their cash away to banks, hedge funds and other financial actors who needed liquidity. Supply contracted and the price (=the interest rate) spiked to above 5 %.

Therefore the Federal Reserve had to step in and supplied additional cash on the repo market which brought interest rates back to previous levels. The Fed bought US treasuries and gave cash to the financial actors who needed it.

Basically, this was nothing else than QE, although Jay Powell claimed that this was not QE. This was the restart of QE by the Fed or, as i call it, the beginning of QE infinity.

To be clear, the Fed was always engaged in the repo market but had stopped it when it launched its' first version of Quantitative Easing. Following chart is from a research paper by Jim Bianco (Bianco Research) from December 2019:

I recommend to read this as it shows very interesting parallels between the Fed activities from 2019 and those from 2000, at the height of the dot-com bubble. As we can see in the chart above, the problem in 2000, 2008 and 2019 was a lack of liquidity. Banks stopped to borrow cash to financial actors with a high counter party risk, demand for cash exceeded supply for it, so to say and therefore interest rates spiked.

The situation is different today. When back then a lack of liquidity was the problem (caused by the Fed itself because it has encouraged financial actors to take higher risk), it is the exact opposite now. During the pandemic, the Fed has flooded markets with liquidity and pushed interest rates down to zero and told market participants that they will not raise them prior to 2023.

If demand for collateral (US treasuries) exceeds the supply for it, those who want the collateral will start to bring down the price for cash - interest rates fall. Actors who demand collateral may start to pay others to take their cash in exchange for the collateral.

As a result, overnight repo-rates go into negative territory, which they did prior this year. However, this is no scenario the Fed is looking for as Powell said in an interview on 60 minutes in May 2020: Negative interest rates is probably not an appropriate or useful policy for us here in the United States.

So the situation has been turned around because of large injections of liquidity by the Fed: Usually there is demand for cash on the repo market, but now there is demand for collateral because excessive liquidity has to go somewhere. As a result, the sum of reverse-repos (taking collateral against cash) is rising.

This shows, how hard the banking system is struggling with excess liquidity, induced into financial markets by the Fed. The result: So with one hand, as part of QE, the Fed is buying $120 billion a month in Treasury securities and MBS. With the other hand, the Fed took back $351 billion via overnight reverse repos, undoing nearly three months of QE. (wolfstreet.com).

As mentioned in Wolf Richters' article, the Fed is aware of this as its' members have already discussed the issue according to the latest FOMC-Minutes. Bank Reserves, parked by commercial banks at the Federal Reserve, have exploded to 3.92 Trillion dollars, for which commercial banks receive a .1 % interest.

The Fed is aware of the fact (as shown in the FOMC Minutes) that there is an enormous demand for US treasuries on the market place.

What is additionally driving the demand for treasuries is short-selling, which works in the bond market the same way as it does in equity markets: Short-sellers have to borrow the bond from someone who possesses it to sell it on the market place. Usually they borrow from a verified dealer who does this for pension funds or insurance companies who are the main lender as they are obligated to hold a huge amount of treasuries.

But when there are not enough treasuries in circulation or there is no demand for cash because of excess liquidity, then those short-sellers have to offer the counter party to give them cash at a negative rate. They pay them to take their cash, which is no problem if yields rise (bond prices fall) and the short-seller can buy back the bond at a cheaper price. As shown below, this trade has worked well since last August as the yield curve has steepened.

Additionally there is another player, apart form the Fed, who is currently providing excess liquidity. The US treasury under Janet Yellen is pumping liquidity into the system.

During the pandemic, the US treasury issued big amounts of bonds and filled up their General Treasury Account at the Federal Reserve, so the money it borrowed was not spend immediately, but put on the TGA. In February, Janet Yellen announced that the US treasury will start to spend this money into the real economy.

Because of all this events, some analysts expect that the Fed will be forced to start tightening in fall this year. Otherwise the ongoing QE-programs may extract too much treasuries from the market to keep the financial markets functioning. This imbalance was mainly caused by the Fed and Yellen is putting fuel to the fire by unwinding the TGA.

Now that we know why the situation on the repo market is as it is, I want to discuss some probable scenarios what could happen next. The Fed has maneuvered itself into a situation where there is no easy solution.

Let us think about this: To bring the imbalance, excess liquidity or lack of collateral, back to equilibrium, the US treasury has to issue more debt to increase supply on the one hand and to take liquidity out of the market.

That is why it may be necessary for the Biden-Administration to go for another stimulus-package, followed by another one or a Green Deal or a big infrastructure plan. This may bring supply and demand back to balance.

Everyone is expecting a rise in interest rates and the US 10y at around 2 % later this year and as a result, many market participants are short US treasuries. But what if there is no additional stimulus package or an infrastructure spending program? (hard to imagine, I know!)

To profit from a rise interest rates, one has to be short bonds and borrows US treasuries to sell them on the market place. Simultaneously the Fed is buying big amounts of treasuries and thus draining supply of those, if no additional new issuances step in.

If the supply of treasuries is falling, the supply curve is shifting to the left and the price for treasuries is rising; interest rates fall so to say. Thus, as everyone is short treasuries, at some point those have to cover their position and therefore buy treasuries, bidding up the price of those further. Hello Gamestop, we have a short-squeeze in the bond market.

This is not only a problem within the United States, as the dollar is the world reserve currency and treasuries are seen as dollars. When there was a shortage of treasuries in the past, one did buy other, riskier assets, like a MBS for example. Alternatively, a treasury bond could be lent not only once, but twice, or much more often. However, this would make the system highly vulnerable. In the end, this could lead to a dollar shortage and as a result the dollar would appreciate measured against other fiat currencies.

Currently, I am very much convinced that this scenario is not going to happen, because the Biden-Administration undoubtably is willed to push through more stimulus programs in the future. This week the administration announced a 6 trillion dollar budget that would push federal spending to its highest sustained levels since World War II.

But let's think about the second scenario where the US government is blowing up its' deficit, issuing more and more bonds to the market. Those new emissions will fill up the TGA again which - on a certain point - have to spend it again into the real economy. If banks buy the newly issued bonds, the spending is highly inflationary while, if the consumer or a non-financial company buys it, there is no such effect as the money put into the system is already taken out of the system.

But if new issued money is constantly entering the system while the economy is not growing at an equal pace, prices will have to rise as more money is chasing the same/fewer amount of goods.

If inflation picks up, inflation expectations will also rise and thus interest rates will have to rise. The only tool the Fed has to fight rising rates would be to expand its' asset purchases and simultaneously the treasury has to issue even more bonds to forfeit a shortage of collateral.

This is where the system is on the edge of imploding. As soon as market participants realize that there is no way out of this spiral of interventionism, they will start to spend their cash holdings and income as soon as possible to buy non-inflatable assets and other consumer goods (equitites, commodities, precious metals, cryptos, consumption goods) and the final Katastrophenhausse (crack-up boom) begins.

Both scenarios have some probability (I personally think that the second one is of higher), but I'd say that the time horizon where all this is happening can stretch from either a few months to many, many years, and thus it is hard to speculate on such events. The Fed may have some more ideas right around the corner (as there are intelligent people working there) to postpone the day of reckoning...

Have a great weekend!

Fabian Wintersberger

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity.

Comments

Post a Comment