The NeverEnding Story

One year ago the corona pandemic reached Europe and same is true for the Chinese approach to fight the pandemic. We all know the pictures from Italy and how people and governments all around the world started to panic.

Because of uncertainty - which partly lasts until today because of a lack in valid data - countries all around the globe started to shut businesses down and to impose lockdowns over the population: All EU countries (except Sweden), India, Argentina, Australia, New Zealand, many US States (democratically led), to name just a few. The world economy was switched off.

I want to use todays' commentary to look back and to cover the economic impacts of the measures that governments took to fight the pandemic and how governments & central banks tried to fight the consequences that their own actions caused.

Further I want to talk about the present: The start of vaccine-programs seemed to be the game changer. However, with new news about mutations of SarsCov-2, I observe that panic is back. One side wants to end all restrictions (because of vaccination) while others want to keep restrictions for longer (despite vaccination).

It is possible that those restrictions and its' consequences may be here to stay for longer than we wish for. Additionally it is obvious that many politicians like to govern by decrees and do not have to deal with 'democracy'. But can fiscal expansion and central bank policy really go on forever? I will get back to this later in the commentary.

On January 23 the Chinese government locked down the province of Wuhan and ordered people to stay at home. They were allowed to buy essential goods, but only in certain time spaces. When I heard about this, I thought that something like that would never ever be implemented in Europe. On March 16, my country (Austria) imposed lockdowns, and many others with them.

Stock markets anticipated those events when it was obvious that Covid19 would indeed become a problem for western society. While the Dow Jones was close to 30,000 points at the beginning of February, it fell about 36 % until mid March.

On the regular FOMC meeting in March of 2020, the Federal Reserve slashed interest rates by 50 basis points to 1 %. However, when stock markets continued to crash, the Fed slashed rates further down to zero on a Sunday emergency meeting. Accompanied by an enormous Pandemic Purchase Program and by a first round of government stimulus, stock markets turned. What followed was - to stay within former President Trump's diction - the greatest recovery ever.

Within the Euro-Area, the ECB was not able to slash interest rates further (but you probably know that), because interest rates have been in negative territory already. The ECB did implement another asset purchase program, PEPP, to keep markets liquid. Although the recovery is lagging the recovery in the US, European markets have reached pre-corona highs.

The ECB and the Fed saved equity markets in March 2020 because they guaranteed endless liquidity which caused markets to turn and to look more positive into the future. The narrative of a soon reopening of the economy and a vaccine on the horizon was the dangling carrot in front of investors' noses.

In the bond market, bonds like US-Treasuries and German Bunds were demanded heavily ahead of the crisis before investors where forced to sell them as well when they needed cash to fulfill margin calls. When equity markets went up again, so did bond markets until in the recent sell-off started to kick in at the beginning of 2021.

The ECB and the Feds' bond buying programs were able to calm down the corporate bond market too. The Federal Reserve started to buy corporate bonds for the first time to support markets while the ECB already did that since the European sovereign debt crisis. Here are the yields for US junk bonds and high yield corporates...

... and here are European corporate bond yields.

The liquidity that was provided by central banks saved financial markets and prevented are more severe crash. John Authors cites Jim Bianco in a Bloomberg commentary, who said that the Fed literally nationalized the bond market.

However, there are costs to these central bank policies. The Fed and the ECB were forced to sharply increase their balance sheets: The Fed balance sheet has doubled while the ECB's rose by 50 %.

Labor markets results where different on both sides of the pond. While the US relied more on additional benefits for unemployed, Europe mostly implemented the German/Austrian model of 'Kurzarbeit', where the government subsidizes wages to prevent people from getting unemployed (while people cut down on working hours).

Because the United States is vaccinating people much faster and many states have already abandoned all measures related to Covid, unemployment has fallen rapidly and is now below the European unemployment rate. Less regulation is another cause here in my opinion.

Europe, especially the EU, where member states let it up to the EU Commission to purchase vaccines, has failed badly doing so. Accountable for this is 1) all European prime ministers and 2) the European Commission, but none of them wants to take responsibility for that. As a result, the big reopening will be delayed in Europe and therefore we will lose important time to get back to the path of economic growth.

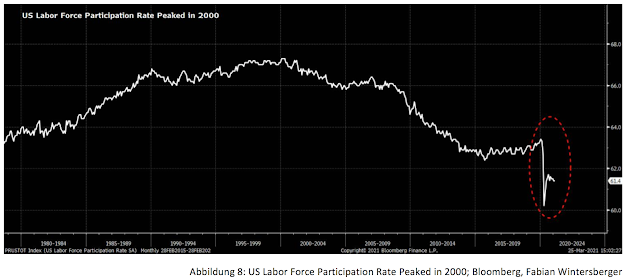

However, I would like to throw in a chart here which is mostly overlooked and that is US labor force participation rate. The US labor force participation rate peaked in 2000 is steadily going down since then. More and more US citizens within the working-age population give up on looking for jobs and therefore are not included in the US unemployment rate. Therefore, US unemployment might be higher than it seems.

The more people are vaccinated, the more restrictions can be lifted. Economic growth will pick up fast in Q2 or the second half of 2021 at latest, according to many analysts and economists.

What remains is high levels of corporate debt which increased sharply during the crisis because of government guaranteed loans and tax deferrals. One hopes that catch-up effects in private consumptions will compensate for that after the personal savings rate is still way above pre-crisis levels.

It is true that this catch-up effects may raise demand for goods and services but the question remains: How far can companies increase production to satisfy additional demand? Especially because economic investment would be very important in such an environment and highly indebted companies are more likely to not increase investment.

There is a difference to previous crises, as the following chart shows: In previous crises, corporate debt decreased (or at least stayed constant):

Therefore I understand why Jay Powell and Christine Lagarde are begging governments to increase fiscal spending to fill in the lack of private investment. The problem that I see is that previous experience with additional government spending speaks against the Keynesian argument that higher government debt will pay off itself.

Additionally there are rising inflation expectations of markets participants. Currently the rise in inflation expectations is a sign of a strengthening economy, according to analysts and economists. However, if inflation will not be temporary, this could lead to a reduction in real consumption for low-income households. Sadly, reality differs from Claudia Sahm's assumption in her New York Times commentary: If prices rise by 5 %, wages would need to rise by 5 % as well to keep consumption steady. This was certainly not true for the last 30 years and therefore I also have to disagree with Oberbank CEO Franz Gasselsberger: I do not expect a recovery like never before.

German journalist Andreas Kluth writes in a Bloomberg commentary that we have to prepare for a permanent pandemic because of virus mutations. According to Kluth it is highly unlikely that we ever get to herd immunity against Covid19. If his assumptions come true, the optimistic growth estimates will become obsolete. He writes about a possible scenario of endless cycles of outbreaks and remissions, social restrictions and relaxations, lockdowns and reopenings.

How we should pay for this and (even more important) where we get all the goods and services we demand if everyone stays at home forever because of staccato-lockdowns - I do not know. One year ago I thought that a 'Wuhan-Scenario' is far away from Europe, but after one year in this pandemic I have to say: China is already here! The times of economic and social freedom seem to be over for many years. To govern by decree is too attractive for government officials...

Have a great weekend everyone!

Fabian Wintersberger

Have a great weekend everyone!

Fabian Wintersberger

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity.

Comments

Post a Comment