The Paradigm Shift

In what a crazy environment we are living! There’s no day where you don’t wonder about crazy price movements in the markets.

Still, many people argue that those price movements are solely a result of supply-chain bottlenecks, a Russian president withholding gas from Europe and China, or other factors. Maybe they’re right, and partly they indeed are. But there is another story to tell here…

That is why I love the model of supply and demand. Although there are many criticisms to it, like it makes unrealistic assumptions that don’t withstand reality, it puts down so nicely why the current inflationary pressures were inevitable given the response by central banks and governments. Below I want to discuss what I mean.

In 2020, governments told their people to stay at home and stop working from one day to another. As people did not go to work, production in the affected sectors fell, and usually, no work means less income and thus lower demand. Therefore, the price level would have remained unaffected in those sectors and all other parts of the economy. Prices would have to go down, where demand went down faster than supply, as the model of supply and demand would suggest, or prices would have remained stable if both sides of the equation diminished equally.

However, two things happened. Central banks bought corporate bonds to keep interest rates and, thus, low borrowing costs to keep businesses alive. Secondly, governments supported the people out of work. As most companies were closed, and demand was held steady, consumers had to decide: What to buy?

While recipients saved a part of those transfer payments, another part was spent, which drove up prices where demand went up—things like home furniture and housing. House Prices in the countryside went up (higher demand) while apartment prices in the cities went down. Due to the introduction of home-office, office buildings shared the fate.

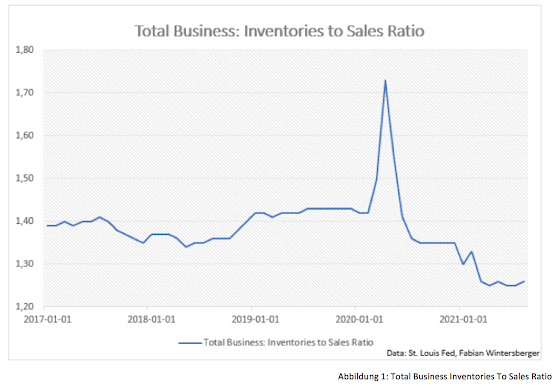

The higher demand for housing materials bid up prices, while production was lowered due to the lockdown policies. At least the businesses operating faced a pick-up in demand, which drove down their inventories.

Later, when the economy reopened, demand increased further, and while many people still are/were afraid to go back to work, companies experience(d) a shortage of workers.

Since demand continued to recover and money spent, another problem hit the economy: A shortage of raw materials because production was not running at full speed. A worker shortage equals lower supply, and hence companies have to offer higher prices (=wages) to get workers. Commodity prices went up, one after another. While governments and central banks pumped money into the system, adding fuel to the fire of rising prices.

However, the shortage of commodities spilled over to other sectors of the economy. Facing increasing demand, firms could not get the raw materials to produce input goods, take the problems in the semiconductor industry, for example. Thus, many of them halted or scaled back production. In the case of the semiconductor industry, the problem spilled over to the related parts of the economy. Automakers couldn’t produce the number of cars required because of the shortage; hence people looked out to buy used cars, driving up used-car prices.

Lower inventories led to higher orders, and as a result, shipping costs have gone through the roof until this day. We can only guess what happens next, but as just-in-time production is spread widely throughout the economy, higher shipping rates will possibly lead to higher prices of all goods.

Central banks, on the other hand, exacerbated the problem. The more money flows into the real economy; the higher prices will be in the future. Such policy may help to stimulate demand; it is disastrous during a supply shock.

The latest was the rise in energy costs due to increasing demand and, because of supply-chain issues, lower supply. China, whose economy opened up pretty early, is short of energy and thus is buying up coal and gas heavily on the market, competing with Europe, which also needs gas to fulfill energy needs. In tandem with coal and gas, oil prices have risen due to a rise in energy demand.

As Europe, especially the UK, suffered from a shortage of truck drivers even before the pandemic, gasoline doesn’t go where it needs to in due time. A problem that already existed before Corona.

Higher energy prices drive production costs, and consequently, companies will have to raise prices on their products at some point. We can already observe that import prices, producer prices, and wholesale prices spiked, although firms try to swallow the costs instead of passing them onto consumers. But trust me, at some point, they will.

Additionally, consumers experience inflation in the real economy: although already heavily elevated, asset prices continued to go up. US house prices, according to the Shiller-Index, are up about 20 % year-over-year. CPI does not even reflect that because the BLS uses Owners Equivalent Rent to calculate rent inflation.

Central banks bid up bond prices, and stocks soar because of increasing participation in the market and share buybacks by companies (already the biggest on record). Additionally, stock prices increased because retail demand picked up as lower interest rates resulted in higher risk-taking along the risk curve.

So, how will this end? Honestly, we do not know. Let us assume that asset prices will fall at some point: What happens to the cash that investors are sitting then? If it flows into the real economy, inflation will remain transitory for longer. Furthermore, we do not know how people's actions and behavior have changed since the pandemic.

With all the global imbalances and market distortions caused by interventionism, nobody should expect a rapid pick-up in economic growth. The Atlanta Fed GDP Nowcast is pointing in this direction. The hope that economic growth will be much above pre-pandemic levels diminishes...

I do not think that governments will allow the free market to get rid of all the imbalances because they would result in higher (short-term) unemployment and business bankruptcies, along with spending cuts by the state. However, in hindsight, it was inevitable.

But how will governments get out of this without causing further damage? A new monetary system? A debt jubilee and a restart?

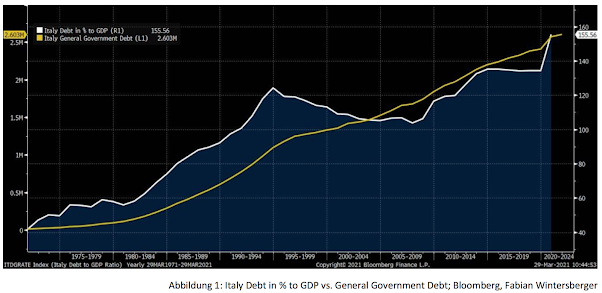

In my opinion, governments will choose to go down another path at first. They will try to keep real interest rates negative to drive down debt/GDP levels while spending big, for example, on infrastructure. The deficits will be funded by the printing press, so was my guess.

I thought that equities would profit in such a scenario because negative real rates will push investors into intangible assets. If asset prices performed similarly to previous negative real rates periods, dividend stocks would be an argument. Here is the chart I posted two weeks ago:

However, this week I have read another interview with Russel Napier, who appeared on the macrovoices-podcast recently. Russel was a long-time deflationist before changing his opinion last year and is now arguing that a regime change has happened.

What caused Russels to change his view? As everyone knows (at least everyone is familiar with the subject), commercial banks create money through credit creation to the real economy. It was a fact that governments took control of the money supply during the pandemic via credit guarantees.

And this is where the governments now got a foot in the door. They issued loan guarantees for borrowers. The banks were thus able to grant loans without worrying about whether the loans would also be repaid. The state finally promised to step in in an emergency.

Because of that, Russel is saying that central banks have become irrelevant. And, because of that, he observed, how financial repression in the 1940s looked like.

His conclusion is exciting: Most investors think that interest rates will rise if inflation goes up substantially. He disagrees: The long-term interest rate will be set by the regulator. They will force the institution to buy it, and the supply of money will be determined by the government who controls the growth of commercial bank credit.

In recent times, bond prices have come under pressure again as inflation expectations rose and central banks signaled that they will scale back their asset purchases soon. As a result, yields started to pick up again.

Nevertheless, Russel's argument against higher rates is fascinating. He refers to the events, how the US government managed to keep bond yields low in the 1940s: Because in a market-determined interest rate, you’d expect interest rates to go up to reflect inflation. But if I’m saying to you, they’re not allowed to, then actually, you don’t lose money on bonds in nominal terms…But the bottom line is your losses in bonds are in real terms and not in nominal terms.

I agree with Russel on this: Real bond yields will stay negative for longer. But his conclusions on what this means for equities is very, very interesting. My opinion always was that it will be central banks who keep long-term rates down.

In the interview, Russel tells Erik Townsend about what happened during the financial repression of the 1940s: Investors were forced to buy US treasuries, although they lost money in real terms. Thus, he concludes that private investors will be forced to keep long-term yields down.

His opinion, what this would mean to equities? Let us see what Russel thinks: The exciting thing is what happens to equities… but here’s the real concern: If we … forcing savings institutions to buy government bonds, they have to sell something. And what they’re going to have to sell is equities…. There will be companies that do exceptionally well from this combination of high inflation and low interest rates that you can buy. But the equity class as a whole would be under severe liquidation pressure from all those institutions that force lower interest rates.

What country would firstly introduce such measures? Russel thinks it will be Europe or China because private sector debt/GDP is higher than in the United States. France and China are just over 20%. More historically, that is exactly the level where you‘ve had issues, he says.

As a result, the US dollar would appreciate compared to those currencies because such measures would lead to a massive capital outflow right into the US market. A very plausible scenario, in my opinion.

Other asset classes that would profit from such an environment would be commodities, gold (and cryptocurrencies?). An artificial appreciation of gold reserves at the central banks maybe is not so far-fetched then, as Luke Gromen repeatedly says: [me paraphrasing] it very well could be that one goes home on Friday with gold being worth 1,800 dollars an ounce. When you return to work on Monday, it is worth 4,000 dollars an ounce.

Although this is still speculation and it may come totally different, this scenario is possible, and therefore I think that one should consider it. However, most definitely, it will be pretty exciting to watch markets in the future.

Have a great weekend!

Fabian Wintersberger

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner, and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in professional or personal capacity.

Comments

Post a Comment