Aggressive Tapering?

After a short summer break I welcome all readers back to my weekly review and hope that, despite the not so sunny weather, everyone of you had a 'great summer'.

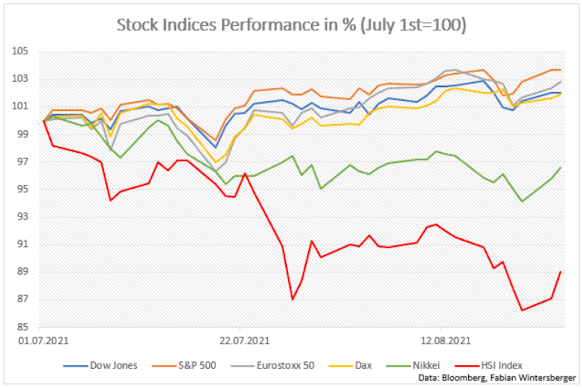

However, summer was good for most investors if one was invested in European and American markets. There are not many days, where the big indices are not making all-time highs.

On the other hand, the summer was not that good for those who invested into Asian markets: Japan has been struggling with a rise in covid cases, which may has led to a four per cent decrease in the Nikkei compared to the beginning of the summer.

In recent weeks, China has started to lock down some regions again due to an increase in covid cases which may be a bad sign for the world economy. Although much more negative has been the rising interference of the communist party to specific chinese enterprises. As a result, they faced an intense sell-off of their stock.

As the main engine of the world economy is struggling, and this has implications for Europe and the United States. China is already experiencing a negative credit impulse, which very well could lead to a slow in world economic growth. China credit impulse YoY is correlating with US 10y yields with a 6m lag and this could be a sign that the reflationary environment has already ended with the start of the summer.

It seems that the bond market has made the right call, as 10y treasuries are already way below their highs of this year. Simultaneously, despite rising vaccination rates, the pandemic is returning (as many have expected) with the beginning of the fall. As the number of hozpitalisations is also on the rise in the US, there is fear of another round of restrictions in personal freedom.

In the near past, the bond market always anticipated an economic slowdown correctly and the long end of the yield curve is also pointing to a transitory inflation scenario. This could be supported by US inflation of July. Probably, we have already seen peak inflation, but only time will tell.

All eyes are on Jackson Hole, Wyoming, now, where the worlds central bankers are getting together (virtually) this week. Everyone expects Fed chair Jay Powell to give some sort of a time table of how the Fed will taper their PPP.

The Fed has doubled its balance sheet since last year and is still adding about 20 billion dollars per week. Still a very impressing sum, if you think about the fact that during the last couple of months, more and more Fed officials have come out to talk about the plan of tapering. Maybe they want to prepare markets that the step will happen rather sooner than later.

Last year at Jackson Hole, the Fed communicated a shift in its' strategy and has implemented an ultra-loose monetary policy that accepts a (graduate, temporary) overshoot of inflation to achieve better job market results.

But the world has changed since last summer. Joe Biden became US-President and one stimulus package after another followed. The economy has railed back in the first half of the year and a strong increase in demand has led to a shortage of workers.

Still, it is not very clear that this is a sustainable development because there is still a lot of noise in the data. There is, as I already mentioned, strong demand because of government stimulus and still huge supply chain disruptions which, all in all, brought inflation to recent levels. As demand goes up and supply falls, prices rise.

Mohamed El-Erian has acknowledged the same problem in a recent Bloomberg-piece: The Fed's new framework was designed for a world of deficient aggregate demand where supply was not an issue. Coming out of the pandemic, we live in a world of ample demand where the main problem is on the supply side.

Considering this, Jackson Hole may bring a huge surprise for markets because Powell may end up presenting a much more ambitioned tapering timeframe than some may expect.

However, I am still doubtful that there is a realistic scenario where the Fed can really taper without causing more harm to financial markets.

Investors got used to supporting measures by the Fed and many of them have reallocated their capital into higher yielding, riskier investments.

Let's have a look at Barclays US Corporate High Yield Average: The average yield for high yield bonds is still near all time lows of 3 %. Simultaneously, corporate debt has never been that high.

However, nobody at the Fed talks about shrinking its' balance sheet and thus it is a joke, in my view, that we discuss a scenario where the Fed is starting to buy less bonds somehwere in between 2022 and 2023, after the fastes recovery in recent history.

The strong demand for US treasuries could be interpreted in a way that the bond market is anticipating an aggressive tapering plan. If one concludes that tapering has a negative impact on the real economy, it may lead to a dump of high yield bonds and more demand for safe-haven assets, like US treasuries. Maybe this is also an argument why most markets participantes are not thinking that inflation will be a problem over the longer term.

Nevertheless, there will be some sort of tapering plan this week at Jackson Hole. One has to keep up the illusion that the Fed is really capeable of doing so. Otherwhise, some may get nervous...

I mean, let us think back to Janet Yellens time at the Fed. For years, the Fed has talked about shrinking the balance sheet and a rate hike. In fact, Yellen has bluffed at nearly every FOMC press conference that next time the Fed will indeed act. You may remember Yellens' story that shrinking the balance sheet will be like watching paint dry.

The markets fully trusted the Fed, and they still do today, with only one difference: Markets are even more dependent on cheap money and credit from central banks.

I fully agree with the guys from Nordea who write: We envisage a tapering process similar to what Bank of Canada has initiated, which means that the FOMC could end up openly communicating unemployment rate thresholds that would trigger the next tapering phase. Firs, from 120bn to 80bn if unemployment hits 5%, then from 80bn to 40bn if unemployments hits 4.5% and so on.

Also I fully agree with Nordea, that such a plan would have a very bad incentive structure for Powell and Yellen. As a critic of central bank policy I am not at all convinced that the Fed really wants to taper, but that they will have to keep up the narrative of doing so.

I think that the Fed will stop talking about tapering as soon as there is an excuse for doing so. Fall and winter, accompanied by rising covid cases is such an excuse. One can expect that it is highly probable that cases will rise throughout the winter.

At some point, the Biden administration will have to act, or at least they will claim so, and again start to restrict social life. The Fed, however, will be very thankful to restart asset purchases in such a scenario.

Another nice quote from the Nordea-paper: If you were ever in doubt, then just look at... New Zealand... Postponed rate hikes and short-term nationwide lockdowns due to a very few cases... before Jacinda Ardern launches the mother of all lockdowns.

Have a great weekend!

Fabian Wintersberger

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity.

Comments

Post a Comment