Keep On Rollin' (In 2022)

It is hard to believe that this year is already coming to an end. On the one hand, it was such an eventful year, but on the other hand, very little has changed. While we thought that we handled the pandemic when the first vaccines were introduced and finally could concentrate our thoughts on the Grande Reopening, reality has come back to us, especially in Europe, where there was hardly any Grand Reopening.

For now, it is Omicron. As usual (during these times), the warnings become louder and louder that policymakers need to remain cautious as we face the potential beginning of a fifth wave (at least in Europe). In South Africa, the origin of Omicron, the public is mostly unaware of a new variant around now. Although infection rates go through the roof, one has to acknowledge that death rates remain stable at deficient levels. Maybe we should listen to Dr. Angelique Coetzee, who describes the symptoms of this variant as primarily mild, and thus Omicron should be seen as a gift. However, enough about the pandemic (in a narrower sense)...

Due to the rising infections rate and rising economic uncertainty, commodity prices got under pressure again. Oil, for example, is currently at about 72 dollars, which means my call for a 100 USD oil price this year was wrong. No shame about that. Let us see if it was too early or definitely a bad call.

Another prognosis I made in the previous winter and this spring was that inflation was underestimated by central banks. This turned out to be accurate, and so did my call that long-term interest rates will stop rising and probably fall (what they did) in late summer. More on that later.

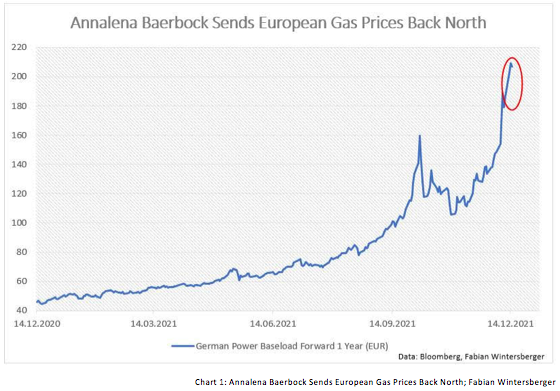

The European energy crisis continues to be a significant problem for the economy (I wrote about this in my last piece). And it did not relax after statements from the new German foreign minister, Annalena Baerbock, last Sunday on national television. Baerbock said that neither the regulatory requirements for a start of Nord Stream 2 were fulfilled nor that the geopolitical tensions between Russia and Ukraine would allow it. No es bueno for German gas prices.

I would like to add that Germany's new three-party coalition plans to close all German coal and nuclear power plants shortly, and thus one may ask how much more suicidal a countries energy policy can get? As I wrote on many different occasions, a rushed transformation of a countries energy supply to renewables without considering nuclear power is a perfect recipe for disaster. If it is garnished with actively sabotaging the relationship with its' leading natural gas supplier, problems will worsen.

The European economy never reopened completely (without restrictions), although the economic sentiment had turned very positive at the beginning of the year, until fall, when sentiment turned negative again. Similar things happened in 2018, and the result was that German equities went sideways until March 2020. In my opinion, history may repeat.

Investors should probably prefer US stocks over European stocks in 2022, albeit the possible headwind from the Federal Reserves' plans to tighten monetary policy. In my opinion, the tightening anyway is too little too late.

Nevertheless, small-cap stocks, representing the backbone of the European and US economy, point to the conclusion that despite record amounts of cheap money being pushed into the system, the recovery is already close to an end.

Inflation has been a global phenomenon this year, even though it has risen more in the US than in Europe (because of the reasons I wrote above). Still, a commitment to a tighter monetary policy stand might also be inevitable for the ECB next year. Maybe we have more information about that by the time this text is published, but as I write these lines, we still do not know. Looking at the Euribor-Futures Curve, we see that the curve has steepened a little bit on the front end but flattens out then. If the market is correct, we will see a return to zero percent interest rates in the Eurozone by 2024.

The flat structure of the curve from 2024 to 2027 (it more-or-less shifted upwards parallel compared to last year) may suggest that the market is not so sure about the economic outlook. Additionally, the ECB needs to look after the PIGS states (Portugal, Italy, Greece, Spain) because those countries are the most vulnerable to interest rate hikes.

Central banks now acknowledge that inflation is a problem that has to be fought through monetary policy measures. However, in Europe, policymakers are still trying to calm down markets. Isabel Schnabel said on German national TV that inflation is still too low over the long run, while Madame Lagarde talked about an inflation curve that looks like a hump.

Even though Lagarde assured that she knew how much high inflation rates hurt low-income groups, I do not buy that she is very much concerned about it. If one looks at wage increases, it does not look like they will keep up with higher inflation because - in contrast to the US - wage increases have been very moderate in Europe this year.

Will Lagarde and Schnabel be proven right, and inflation will fall back below the ECB's two percent target next year? Deflationistas are sure about that, and for quite some time, they have pointed to lumber prices. While the price of lumber skyrocketed at the beginning of the year, it has continued to crash down again since April. However, lumber prices are back at above 1,000 dollars within the latest months.

Another impressive thing this year has been the significant increase in reverse repos. The main contributor to this is the US treasury and TGA drawdown. Mass amounts of liquidity flew to MMFs (money market funds), who parked the liquidity at the Fed instead of investing it elsewhere.

One can, as Jeff Snider (Alhambra investments) does, consider this just the repo market functioning or one can conclude that this money will soon flow back into the treasury market, as Joseph Wang does. A QE Afterparty, one might say...

But let us get back to inflation, which will continue to be a huge topic in 2022, as I am convinced. Contrary to what the ECB is thinking, the Fed believes inflation will be a big thing next year. This Wednesday, Jay Powell said that inflation will be the main focus for the Fed now after the labor market has returned back to pre-crisis levels.

Hence, Jay Powell stated that the Fed will taper faster than planned. However, the move was anticipated by markets a few weeks ago already and Powell more reacted than he acted, in my opinion. Currently, the market anticipates 3 rate hikes next year, and another 3 in 2023. The recently published dot-plots show a similar picture.

My view is that the Fed has not had a chance not to act, although my opinion is that the hiking cycle will be over faster than markets now think (and I also believe that the Fed would be in favor of that). Similar to my assumption, the market is skeptical about the economy, and the eurodollar futures yield curve shows that because after 2024, the curve is flat.

It is only a matter of time until the Fed will reverse course and loosen monetary policy again because it overdoes it with its' tightening ambitions (hard to believe that we are talking about a Fed Funds Rate of 1.75% being the top already). As Mohamed El-Erian puts it: The characterization of inflation is transitory, is probably the worst inflation call in the history of the Fed. And it results in a high probability of a policy mistake.

Further, if we look at the forward yield curve, the market is not convinced that the Fed will not screw it up. Nobody questions that the hiking cycle will not go very long, and the inverse forward yield curve signals that.

So, I stick to my longer-term outlook that inflation will continue to be high while economic activity slows down.

Although, my guess is that the ECB will not follow the Fed and act more cautiously. Thus, the Euro will continue to weaken against the dollar, which may lead to further import price pressures for European exporters as many of them import input goods to produce the goods they later export.

Further, the beginning of the Feds' hiking cycle will also mean trouble for emerging market economies because they (governments and businesses) have issued a lot of dollar-denominated debt. A stronger dollar would mean more economic turbulence, especially in Turkey, where another rate cut (as demanded by Erdogan) will be right around the corner.

European businesses probably will either have to accept thinner margins, or they will have to pass on their rising costs to consumers and hence fuel consumer price inflation. We can already observe that European companies' cost pressures are way higher than for US businesses, at least when we look at the PPI-CPI spread. To me, it seems that US businesses have already passed a higher proportion of their producer price increases to consumers, while European companies did not.

Politically, 2022 will be interesting. After the German elections take place this year, the next exciting election will be for the French president, where Emmanuel Macron is trying to get re-elected. Both the new German coalition and Macron are following the implementation of strict measurements to fight the pandemic.

On the other side of the pond, we will have the mid-term elections where Joe Biden risks losing his majority in congress. His approval ratings are as low as the ones Donald Trump had. To win these elections, I would not be surprised if Biden (and Macron in France) will increase fiscal spending to appease voters.

While we paid a lot of attention to central banks this year (and the previous years), I would suggest shifting our attention more to governments in the coming years. As we know, due to the pandemic, they have implemented policy tools where they can influence the overall money supply (in the real economy), for example, via credit guarantees.

Fiscal spending will gain importance, especially as we can observe a slowdown of Chinese growth (Chinese credit impulse YoY has turned negative last summer already). Next year will start a more extended stagflationary period (from what we know today), in my opinion. Interestingly, some things are comparable to the 1970s situation (and simultaneously are very different), such as high energy prices.

All in all, 2022 will be an exciting year (again), let it be politically or economically!

Have a great Christkind (Austrian version of Santa) and a great start to the New Year!

Fabian Wintersberger

(this was my last blog post this year. The next post will be published on January 14th)

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions, or organizations that the owner may or may not be associated with within a professional or personal capacity.

Comments

Post a Comment