It's All About The Dollar

It's All About The Dollar

-> German Version

Although 2021 is just a few days old, some of us wish that we'd be back in 2020 already. After recent - again harsher - lockdowns in Europe because of the pandemic there's still no end in sight. On the other side of the pond Trump supporters have made their way into the Capitol and the National Guard was needed to normalize things in Washington. After the recent Elections for Senate seats in Georgia, the Democrats now have gained a majority in the Senate as well, making the blue wave complete. This and prospects of possible inflation has caused a rise in US treasury yields which are now back at well above 1 %. In the meantime stock markets continued in their wild uptrend in hope for an additional, even bigger, stimulus program. Some politicians already swear us to the coming "Roaring Twenties". Are we heading for a golden decade? One key element to observe will be the further development of the US-dollar and US yields.

This New Year will be exciting, that's for sure. Extraordinary valuations continue to become even more extreme as they were back in December even though they were questionable already then. Stock prices continuously make one all time high after another and many analysts expect that this could just be the start of another strong rally. All Western countries have already started vaccination programs which fueled hopes that we may be back to normality after the summer (if everything is going according to plan). If this happens this will lead to huge rise in consumption according to many economists. They claim that consumers will catch up all that they missed since March 2020 because of Corona.

Is this idea that consumers will catch up their consumption really a thing or may there be other trouble ahead? Well, for now let us look back a little bit to see how we got here: After the big stock market crash in March 2020 markets have recovered pretty fast. On the one hand because of central bank interventions and government programs, on the other hand because of extremely high expectations that things will get much better soon. You know the argument: Markets are forward looking!

Forget about how bad the numbers are now! It's a Pandemic! Think about how they may be in one or two years - this sums up the overall mood of investors.

Main driver for the recovery has been the American markets which reached new all time highs again pretty fast although the narrative why this is the case has been changed a few of times. Mohamed El-Erian talked about this in a recent interview with TheMarket.CH:

Before the pandemic, the narrative was that Trump was going to win, that we are going to have continuous tax cuts, and that companies are going to benefit from more deregulation. Then, that political narrative gave way to: We’re going to have a divided government, and that’s good for markets because it keeps the government out of the way. Next, the narrative changed again to: We’re going to have a blue wave and massive stimulus. Now, it’s all about the big reopening trade

The big reopening trade should be a strong case for small-caps because the are more dependent on real economic developments. If the real economy is booming it will support stocks in the Russel 2000. A look at the chart shows that this trend is already observable but if you look at small business expectations, that shows a completely different picture: The index made a new all time high while expectations become more pessimistic.

Abbildung 1: Russel 2000 vs. Small Business Expectations, Reuters, Alessio Urban

More and more traders jumped onto that wagon. Now "short dollar" is one of the most crowded trades. If you look at the Chart, the dollar is near it's supporting upward trend line while technically it looks strongly oversold.

Abbildung 2: DXY; Pictet Asset Management, Julien Bittel

The bigger picture looks a little bit different though: In the DXY the dollar is weighted against other major currencies like the Japanese yen, the British pound, the Canadian dollar, the Swedish krona and the Swiss franc, but mainly (more than 50 %) against the euro. The dollar lost value against all those currencies except the Yen. So is there a dollar crash?

If you look at the valuation against emerging market currencies this assumption evaporates. Jeff Snider pointed this out in a recent post where he also shared the following chart: Compared to currencies like the Indian rupee or the Vietnamese dong the dollar did not move very much.

Abbildung 3: Dollar Correlations (USD/INR; EUR/USD); Alhambra Investments, Jeff Snider)

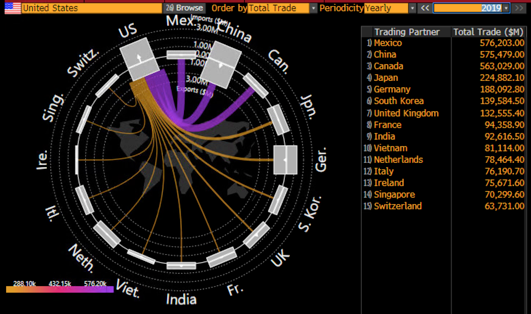

A further look to trade flows shows that the United States trade a lot more goods and services with emerging market countries than it trades with countries within the DXY.

So by looking at the facts I tend to agree with Jeff that there is no dollar crash (or DOLLAR CRASH!!! as he puts it). Additionally I expect that the devaluation of the dollar against the euro will be temporary and that the move mostly happened because of the narrative that European countries managed the pandemic much better that the US. The recent spike in corona cases in Europe tells a different story. Moreover scientific evidence points out that lockdowns do not work and maybe they do more harm than good. I'd like to add: If the vaccine works out really well and we do see a normalization rather sooner than later, the US probably has a much better chance to generate growth than highly regulated Europe.

Another case against a falling dollar is that the dollar is still the worlds reserve currency: The international eurodollar system grants that demand for dollars is still very high and that this will not change any time soon. Many emerging market companies issue dollar-denominated debt to attract foreign capital and commodities are traded mainly in dollars too. Especially oil place a huge role here: After Nixon closed the gold-window in 1971 a main support of the dollar regime has been the established petro-dollar system.

With regards to the point of dollar denominated debt and the eurodollar market Lyn Alden wrote in a blogpost (I highly recommend you to read this article about the petro-dollar system):

That dollar-denominated debt represents a consistent source of demand for dollars to service those debts. So, if recessions happen, or dollar-based global trade slows down, there can become a scramble for dollars which can be in short supply outside of the United States, causing an international dollar spike. This happened in March 2020 as the pandemic sharply diminished global trade, and oil prices collapsed.

Therefore I would dismiss the argument that the dollar is on a crash path and would argue that more likely we will see a short/medium term rise of the dollar compared to other fiat currencies.

Since the beginning of the year the dollar bounced back from it's lows already and appreciated against the Euro. I would assume that this partly happened because of hopes for a catch up in consumption in the second half of 2021 and moreover investors seem to expect a pick up in inflation.

Because of rising inflation expectations market participants assume that the Federal Reserve may start to taper it's bond purchases at some point and will prepare markets for a rise in interest rates. I come to this conclusion because the US treasury yield curve has steepened sharply recently.

Since January 1st, 10y US treasury yields have spiked about nearly 30 basis points and are back above 1 %. According to this recent move it becomes plausible that inflation may pick up at some point. Some Federal Reserve members have fueled this assumption recently by claiming the Fed may act rather sooner than later, but others board members pushed back later this week.

The CPI shows no signs of inflation though; CPI-numbers remain well below the Feds 2 % target. However if you look beneath the surface, prices already rise in many parts of the market economy: Used cars, building materials, steel products, shipping services, housing prices or food to name just a few.

On the other hand 10y treasury yields are still way below their five-year rolling average of 2.1 % which means there is plenty of upside potential.

A rising dollar, accompanied by rising yields lead to some worrying implications for bond and stock markets. Remember: Extreme valuations have become a new normal. Rising rates would lead to falling bond prices and this will have an impact on stock valuations as an analysis by Morgan Stanley shows.

According to the Business Insider article the analysts conclude that

"Based on some simple relationships with stocks, commodities and economic growth projections, the 10-year US Treasury yield appears to be at least 100 basis point, or 1%, too low"

and

"An increase of 1% in the 10-year US Treasury yield from current levels would lead to an 18% decrease in the price/earnings multiple (P/E), all else equal. For the Nasdaq 100 index, such a rise would equate to a 22.5% decline in the P/E,"

My expectation is that it depends heavily on the US-dollar if this projection becomes a reality or not. Recently a low dollar meant tailwind for stock prices, but the higher the dollar appreciates the more likely this slash in valuations may become a reality.

A strong dollar (accompanied by higher interest rates) would hurt domestic production and encourage more imports (as they get cheaper in dollar terms) and may lead to even more transition of production to other parts of the world (emerging markets namely). Further the drop in P/E ratios would push pressure on stocks.

If the dollar continues to fall the situation becomes very unlikely. On the one hand this would strengthen the international trade position of US producers because they would be able export more goods, on the other hand this likely would lead to another huge pick up in the trade deficit and further may lead to a spike in longterm rates and inflation (because imports/commodities get more expensive). If the the Fed intervenes again to lower yields the dollar may fall even further and inflation may skyrocket. Stocks may rise in such an environment but the question will be: Do they also rise measured in other currencies?

As long as global demand for dollars is high because of the international eurodollar system I doubt that we would see a big drop in the dollar. The aspect that Russia now holds more gold reserves than US treasuries may contradict this a little bit although we would need to wait if other countries follow. Then this may put pressure on the dollar system.

However this developments should be monitored: If you figure out what the dollar does you can modify your investment strategy after it. If financial markets get under pressure again this would be a bad start into the Roaring Twenties.

Have a greet weekend!

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity.

Comments

Post a Comment