The Danger Of Rising Rates

After his second term as president of the European central bank ended in October 2019, Mario Draghi is back on the political stage. Following a meeting with Italian president Sergio Mattarella, Draghi declared that he agreed to become prime minister and to form a new 'technocratic' government. However, the world has become a different place since he left office at the ECB: We're in de midst of a pandemic we're fighting with more debt on the economic side while total debt is already at World War II levels. At the same time, stock prices are at all time record highs although all the euphoria does not find its' way into the real economy. Rising interest rates may interrupt the highly anticipated party...

"Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough"

This statement my Mario Draghi of July 2012 is known everywhere in the financial world. This statement was enough back then to calm down market turbulences within the European debt crisis. The assurance that the ECB would intervene and buy government bonds whenever it would be necessary was then implemented in 2015. The program lasts until this day and we are far from ending it.

So, now Draghi was called to rescue Italy and the Financial Media is overoptimistic that he is able to achieve then. Draghi is the best person for the worst Job, Fernando Guigliano wrote in a Bloomberg article. Apart from a health- and economic crisis that every country battles currently, Italy was already in economic troubles before the start of the crisis back in March 2020.

"The former European Central Bank president has an unrivalled record in crisis management, having steered Italy and the euro zone through some of the worst turmoil of the past three decades."

Without doubt Draghi was able to prevent the euro from collapsing when he was president at the ECB although I am not convinced that he did anything to really solve the crisis. His policies to save the Euro have been - and still are - accompanied by huge costs and the Covid19 pandemic has caused even more intervention by the ECB than during Draghi's term.

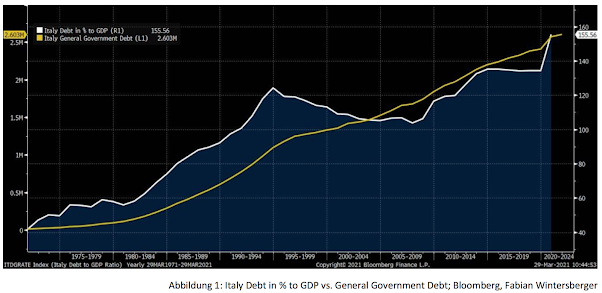

The 'reforms' that Draghi inquired from the euro-area members mostly have not been implemented in the affected countries. On the contrary the actions by the ECB led to an expansion of government expenditures but mostly failed to bring back economic growth. Those governments preferred to simply spend the money instead of investing it into useful projects. It will be interesting if Draghi will implement those reforms now that he sits on the other side of the table now and if he achieves to reestablish economic growth in Italy.

However, the Italian bond market showed signs of relieve after the announcement: Italian 10y yields dropped about 8 basis points on Wednesday and are now on it's way back to 0.5 %. Though it is uncertain that this trend will continue much further as global bond markets show some signs of a cool-down.

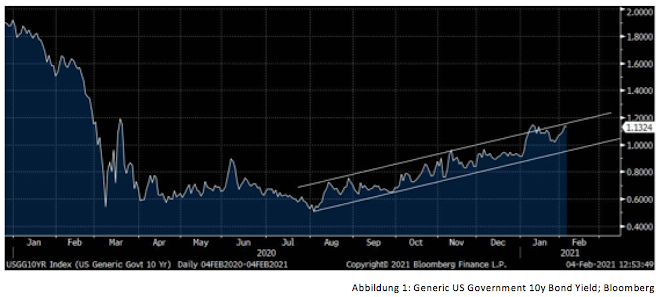

Since the start of the year rates in Europe and the US are in a clear upward trend, especially US yields showed strength and rose more than 20 basispoints (that is about 60 basis points off the lows from August 2020).

Rates are on the rise because many market participants expect a possible return of inflation on the one hand and on the other hand because of expectations of a pick up in growth rates this year, as soon as enough people are vaccinated to reopen the economy. That is why investors are loading up on risk and sell bonds to buy equities.

I also believe that economic growth will return and the economy will expand, at least compared to 2020. The unknown variable within this equation is the date when economies will reopen again. The latest stock market bull run relies heavily on those expectations.

Higher rates may indeed could become a problem and stifle growth. Especially firms with already high debt are very vulnerable in such an environment because as a result of rising rates they now face higher borrowing costs and may fail to cover their interest payments with their revenues. Further governments would also suffer under a rising rates regime because as they tried to fight the economic troubles (which they unintentionally made worse because of their own actions) with extraordinary spending programs they rushed deeper into debt as well. Global debt has risen by 19.5 Trillion US-dollar in 2020, the year of the Great Lockdown.

Politicians endlessly say that we are in the middle of the worst crisis since World War II. If they would refer to the debt-level when they are claiming this I would agree. Global Debt skyrocketed in 2020 to 123.9 % to GDP in advanced economies, only slightly below the 124.1 % high after the second World War.

Historically low interest rates set by central banks and huge asset purchase programs made it possible to bear such debt levels. Central Bank balance sheets are still rising rapidly: The Federal Reserve, the ECB, the BoJ and the Peoples Bank of China hold 28.6 Trillion US-Dollars in total assets now. All four have pumped about 9 Trillion US-dollars of liquidity into markets in 2020.

A load of this liquidity has flown back into the bond market and created massive distortions of an unprecedented extent. Countries and Companies took their chance to expand borrowing, with companies selling a record amount of 4.4 trillion US-dollars of bonds in 2020, a YoY change of 28 %.

As a result risk spreads for high yield bonds are back at historic low levels and interestingly the spread has not widened during the latest rise in rates. Obviously those high yield bonds look attractive to investors even though I think that risks are mispriced heavily. However, if the current rise in yields continues this would put pressure on the high yield corporate bond market at some point.

The problem that I see is the situation we are right now when allegedly we are at the beginning of something like the 'roaring twenties'. Stock markets are already at all time record highs although I think that the current rally is running a little bit out of steam lately. However I do not think that the overall optimistic sentiment will disappear anytime soon and that dips will be bought further.

Apart from all the 'reopening' euphoria and more stimulus hopes for the economy the sudden rise in volatility tells a different story and may hint that there is still some kind of uncertainty. Considering that stocks are at record highs, volatility is extraordinary high.

One may argue that the rise in consumer sentiment because of stimulus hopes shows that there is still hope to expect an big jump in spending but I am not so sure about that. On the one hand because the narrative of reopening the economy is still just 'hope' and on the other hand because small businesses, which are the backbone of the economy, are not hiring.

If businesses are not hiring - how shall this lead to a big rise in consumption? If the US is adding jobs at current pays, Total Nonfarm Private Payroll Employment will be back at pre-crisis levels in about 6 years.

Those numbers are very disturbing for the global economy because I expect the United States to recover much faster than the European countries. Economic activity is well below pre-pandemic levels but Europe is further and further falling behind the US.

In the US the big drop in personal income is cushioned by the stimulus-bills from the (former: Trump-) Biden administration while most European countries rely on the german 'Kurzarbeit'-model. The result is that there is a lower rate of unemployment as a result of the pandemic but also hinders the economy from fast transitions into an economy that better fits to current economic needs.

This and less regulation are a major cause why the US economy is recovering faster from economic downturns that the European economy and certainly it will stay that way. Hopefully we will enjoy a full reopening of the economy in the second half of 2021 at latest. Because of the expected rise in economic activity investors also expect a return of inflation and many are betting on the reflation-trade. The danger here are rising rates which may rise until they become a danger to the global recovery because the debt becomes unsustainable.

With our economic policies we have supported capital consumption through zombie-companies which we kept alive. That is why I do not think that we will get out of this crisis through consumption and because of that I consider a stagflationary scenario in the next years as very probable.

If I take a look at commodity markets where lumber is at an all-time record high (which allegedly leads to delays in construction projects already) and food prices are rising rapidly this confirms my assumption. In the end it does not matter that HCPIs are obviously underestimating inflation.

As I already wrote last week I expect all those things to cause problems earliest in the second half of this year because the market is carried by hopes and dreams as long as we do not reopen. However, rising interest rates should make investors cautious. Shorting bonds may also be a bad game because central banks are a huge factor within it. The question is how long they will stay on the sideline before they start acting.

I am still heavily convinced that the ECB and the Fed will start buying equities this or next year which would lead to a last crack-up boom in stocks while at some point I suspect that all their interventions in the bond markets will run out of control. This would be the case when inflation would pick up much stronger than the market currently expects.

As a result the bond bubble that the Fed and the ECB fueled over years may pop. Then there are two scenarios: Either the strong rise in rates would bring governments, companies and households on the brink of bankruptcy or the Fed and the ECB will let inflation run it's course while they control government bond yields and governments and inflate away their debt. This is the 'zero-interest rate trap' where central banks have landed because of their loose monetary policies and destruction of moral hazard. History shows that the second scenario is much likelier as we have seen after the second world war by controlling the yield curve.

In this respect, it is almost an irony of fate that not only Janet Yellen, but also Mario Draghi has taken office in government. Now the get confronted with all the results of their own actions when they stayed at the height of the Fed and the ECB. Sadly, we all have to suffer the consequences...

Have a great weekend!

Fabian Wintersberger

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity.

Comments

Post a Comment