You Can Drown A Horse In Water, But You Cannot Make It Drink

For some time now, inflation expectations have been rising in the United States and, to a lesser extent, in Europe. Since the beginning of the year investors assume that the return of economic growth will lead to a pick up in inflation and some economists (for ex. Olivier Blanchard) already warn that the economy may overheat because of the huge stimulus measures. All this expectations led to falling prices of US treasuries and German bunds and an increased risk appetite among investors. In the US the "reflation trade" has been pitched very much recently, until we got the official US inflation numbers from January on Wednesday. Although many anticipated that inflation beats estimates the opposite was true. Is it because of the composition of the Index or do other observations draw a different picture? Will inflation be subdued longer?

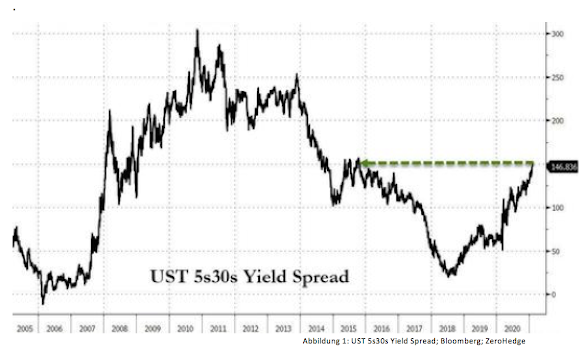

Some traders may have expected that the January US CPI-numbers will beat estimates: Globally, prices of several asset classes where on the rise, longer term bond yields also took of since the beginning of the year, resulting in a steepener curve. The 5s30s spread widened about 90 basis points since January 1st to its' steepest since 2015.

Commodities rose sharply in the previous months: Prices for grain have nearly tripled since Q4 2020 and oil is back at pre-crisis levels. Inflation expectations rose globally and not only in the US, with the 5y5y Euro inflation swap rate at its' highest level since Q2 2019. Flashing red signs...

But the opposite happened: Inflation was below its' expected estimates. MoM inflation rose 0.3%, in line with expectations but ex food & energy, there was no inflation on a monthly basis. YoY both variants missed estimates by 0.1 percentage point.

'At least average hourly earnings rose' one may argue. If you put them into perspective to the unemployment rate, the picture is different though. When unemployment rose back in March of 2020, average earnings jumped along because low paying jobs where lost and fell out of the calculation while medium and higher paid workers where able to continue working from home.

One might ask why inflation remained subdued although all the flashing red warning signs. I'd argue that you have to look at the composition: Housing and medical care have a very high relative importance in the index. Now look at how rent-inflation (relative importance: 42.4 %) has collapsed since the pandemic started:

And the same happened to medical care:

I assume that a possible driver behind this could be the city exodus due to the pandemic where rent prices went down as a result. With reference to medical care my guess would be that maybe people postpone their medical treatments because of the pandemic. However, even though I can only guess what the reasons are I would assume that this effects will turn into the opposite direction as soon as life gets more and more back to normal.

On the other hand I would say that we should think if the CPI measures inflation properly and my view is that this is not the case. Price increases are mostly underestimated by the CPI-numbers I would say.

The ECB and the Fed as well have pumped enormous amounts of liquidity into markets since the Great Financial Crisis of 2008 and their balance sheets have nearly tripled. While the Fed acted faster after '08 (and many assume that the recovery was much stronger in the United States because of that) the ECB has caught up since their version of QE was launched in 2015. During this pandemic both central banks have enlarged their balance sheet by large and actually the Fed started to widen its' balance sheet in fall of 2019 as a result of turbulences on the US repo market.

But in order to influence the CPI numbers the money needs to flow into the real economy via bank lending. If the additional liquidity is reinvested in the financial markets it only bids up asset prices (which it did) but this does not affect the CPI (see also here). A pretty good measure to look at this is revolving consumer credit numbers from the US. If revolving consumer credit rises (see also this article by Jeff Snider), consumer demand goes up and (if supply remains constant or does not catch up at the same rate), consumer prices rise. At the end of 2007/beginning of 2008, revolving credit was at its' high before it fell drastically during the GFC until 2010 and has not recovered to those levels until 2018. The same happened since 2020:

If we are looking at commercial and industrial loans we see that they have remained constant (except for the PPP spike) since 2015:

Another element that subdues US inflation is how the international monetary system works. The international Eurodollar market absorbs enormous amounts of Fed-induced dollars because their is nearly unlimited demand for dollars globally.

Because those new currency units are reinvested into financial assets instead of using it as reserve to make loans to the real economy, no inflation happened. Some economists argue that inflation will pick up because savings went upwards since March 2020 but this is only true for high income households (I wrote about it in one of my latest posts) while many low and middle income households have had to increase spending. I think that the 'reopening' is too little until now that those savings would flow back into the business cycle.

There's an old saying which says that 'you can lead a horse to water, but you cannot make it drink'. With reference to current monetary policy I would argue that the horse's head is already under water, but it has to drink (loans to the real economy) on its own. Too little money finds its way into the real economy. Look at small business expectations, I would assume that their is little demand for investing:

At least the stock market does not care about reality, prices are driven by other factors. If the economic data is good that's proof that the economic recovery is strong while if the data is bad, stock prices rise because of stimulus hopes. Stimulus has not turned on the real economy very much though.

I think that we really have to be 'back to normal' to see an improvement in the real economy. This could be already back in fall this year but still it also could be far from there. My scepticism remains and I doubt that the global economy will return to its pre-recession path anytime soon, if ever. It did not after the GFC and I have not heard any argument why it should be different this time.

In such an environment investors are looking for alternatives and that is why companies like MicroStrategy and Tesla have bought Bitcoin. Additionally Tesla also is open to future gold and silver buyings.

On the other hand there is also the possibility to invest into the stock market outside of the United States, for example in emerging markets or Japan, or Europe (although I would be cautious concerning European equitites because of overregulation on the continent).

If we are looking at labor force participation and unemployment we see that there is still a long road to go to achieve full employment and to get a sound recovery.

If we are looking at payrolls I come to the same conclusion as Jeff Snider that the economic recovery has stalled since June which is stunning because of huge stimulus support. QE still fails to fulfill its purpose and therefore it will not produce sustaining inflation, especially it will not in an environment of economic uncertainty.

As all other major economies suffer from the same problems as the US, how is this going to affect FX-markets? As long all those major currencies continue with their devaluing race to the bottom I expect that the US-dollar will appreciate against those. My guess is that strong demand for dollar assets will result in one or another all time high in US stocks.

On the other hand, gold has not fallen much since last summer which may be an argument against a fast recovery and the same is true for the big rise in the price of Bitcoin. To me it seems that some market participants already think about probable consequences of current monetary policy.

At some point, may it be because of strong credit expansion in the real economy or a final flight out of stocks and bonds into consumer goods because of an other exogenous shock, inflation may be pushed easily upwards into double digits. Therefore I think that everyone should at least consider to hedge this possibility a little bit.

I think that it is an advantage that QE has failed the effects, that central bankers claimed it will have, so far. Otherwise they would see all the misallocations they have caused with their monetary policy. Let me come back to the horse-analogy: Because we have already put the horse's under water it will not start to drink at the end but gasp for air and flood its' lung with water. So let's hope it does not ran out of breath...

Have a great weekend!

Fabian Wintersberger

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity.

Comments

Post a Comment