Underestimated Risks

Now that I have written about the theory and history of stagflation and inflation for 2 weeks, this new weekly commentary is dealing with actual market events. Nevertheless this commentary could be linked to the last two.

Within all the discussions about inflation and current all time highs in equities one could get the impression that the vast majority of analysts, economists and investors are anticipating higher inflation to come.

Contrawise, a recent global fund manager survey by Bank of America, whether the participants think that inflation is either transitory or permanent, shows a different picture. 72 % of the participants think - alike the Federal Reserve - that inflation will indeed be transitory and will diminish in the coming months.

Inflation is transitory, the economy is growing at a high rate and equity markets will profit from this environment, so the majority thinks: According to the survey only 2 % expect a coming bear market in the S&P 500 within the coming six months. This underlines the optimistic view of investors on the US economy, something that I would not have expected.

Thus, no one should be surprised that markets are at such high levels, on the contrary: My opinion is that there is a high possibility that we can expect more all time highs in the coming months, although one should be cautious. Rallies end when everyone is invested.

However, the main argument against a sharp correction in asset prices is the high engagement of central banks (the Fed & the Federal Reserve). Since the beginning of the pandemic, the printing press has been running hot on both sides of the great pond.

As long as worries about higher inflation remain subdued, this money will stay within the financial economy. Therefore, more money chasing a relatively limited amount of financial assets will lead to another rise in asset prices. As long as trust in central banks remains high, this will not change.

Although, if one thinks about it further, it gets obvious that there is another side to it, especially if one looks at current bond yields. Usually the bond market should reflect the potential risk of investors, if they are investing in those bonds. This process of evaluating the risk for a potential investor has been totally completely overturned by central banks now.

For example, greek government bonds with a duration of below 5 years are paying a nominal yield of zero or lower now. This is impressing and worrisome at the same time, especially if one remembers that the country was at the brink of bankruptcy a decade ago, if the EU member states had not guaranteed heavy financial support for Greece and the ECB had not suppressed interest rates.

Another example is the US high yield corporate bond market, where real yields have dropped below zero recently.

Those numbers are another indication in my opinion, why investors could move capital out of the bond market and invest it into other assests like stocks or real estate (according to a recent ZeroHedge article, hedge funds are buying entire Neighborhoods at large premiums as an investment).

To talk about a speculative bubble in the bond market has become mainstream now, but it is highly controversial if the bubbly will pop soon. Although one has to admit that it is very difficult to forecast the burst of a speculative bubble, especially if the big majority of investors is still heavily confident that central banks will act (if necessary). But, as we know, nothing is forever.

Besides the expectations of investors that the current spike in inflation will be a transitory phenomena, the FOMC members are sharing this opinion, although this weeks FOMC meeting could hint that the Fed is not so sure anymore.

On the one hand we got another higher than expected CPI last week and if one looks at core CPI (CPI ex. food & energy), the number was as high as it was last at the beginning of the 1990s.

The picture gets even more serious if one looks at annualized 3-month core CPI change: this number is back levels last seen in June 1982 (!) where interest rates were more than ten percent higher.

Additionally, the CPI was calculated very differently at times when Paul Volcker was chairman of the Federal Reserve than it is calculated today. Maybe Kyle Bass is right when he said in a recent CNBC interview that real inflation is above 10 %.

Although price inflation has spiked in recent months, rent prices where rising at a very slow pace. They are accountable for 42.4 % in CPI calculations and therefore, if rent prices start to pick up (and one could conclude that they will) stronger, inflation could get another push. Expected change in rent over the next 12 months as exploded to 9.5 %, according to Lohman Econometrics and the NY Fed.

Further, freight prices continue to rise and so do energy prices. While prices for copper and lumber have come down from its' all time highs, steel prices continue to balloon.

This indicates that the peak in inflation is still ahead and has not been reached. Inflation is likely to stay high even if it will come down from its' highs. Another leading indicator for the CPI is the producer price inflation for finished goods:

Because of this I was not surprised that Powell changed his stance on inflation, stating that it may stay higher than expected. I think that his goal was to calm down markets in advance, given that consumer price inflation continues to accelerate. We should keep in mind that the Fed's main concern is confidence of markets participants into the US economy. Markets seem to be happy and remain convinced that the Fed has the tools to fight inflation, if necessary.

The published US PPI indices of this weeks supported the argument, that the inflation spike is not over yet. Final demand PPI came in higher than expected again (6.6 % vs. 6.2 %).

While prices may continue to accelerate throughout the summer, other economic indicators look not that convincing. Maybe the US economy is slowing as the 'reopening euphoria' is diminishing.

Retail sales for May were weaker than expected, the empire manufacturing survey was weaker than expected, new home starts disappointed and weekly unemployment data was disappointing too.

With the combination of weak economic data (of a still expanding economy), accompanied by a tense labor market in mind, one may conclude (and I expect that the probability for that is very high) that this are the first signs of a coming stagflationary period.

However, if this really becomes reality, one will have to wait. It will depend a lot on the Fed's future reactions. I am highly convinced that the Fed will not do the right thing, which is to step on the brakes and let the economy rebalance to a more sustainable level, which will be harsh at first, but necessary if the US wants to return to more sustainable growth.

My suspicion is that the Fed will continue to inflate the money supply and therefore asset prices will remain elevated for now, even if the Fed really starts to taper in September.

The scope for the Fed is relatively limited, not only in sight of future tapering, but also when we talk about rate increases. Not only did interest rate suppression and QE lead to a rise in asset prices, but also to an explosion of margin debt.

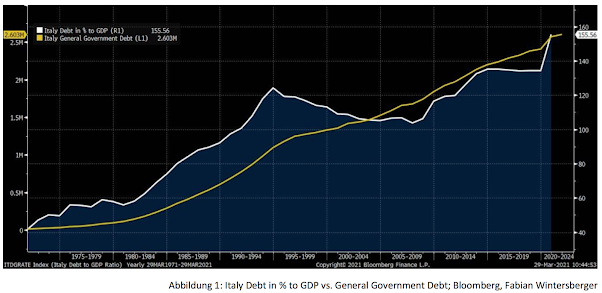

In Europe, the situation is alike although inflation is still way lower than in the US: The ECB has started to monetize government debt and also expanded broad money supply M3 a lot. As a part of the European economy is already zombified (a recent ECB paper acknowledged this too), one may expect that this - accompanied by an expansion of money - puts pressure on prices.

If there is no radical change in course from the Fed or the ECB's side, asset prices will continue to rise as they did after 2008, but with one major difference: Inflation will stay at high levels and economic output will stagnate.

Further one can expect that governments will not stop to hand out credit guarantees because this lets them to influence the money supply.

This way, governments are able to combat weak lending growth. Weak lending growth is one major argument of deflation proponents, why they expect a deflationary scenario: They have pointed out that the bank reserves, that were created by the Fed due to bond buying, did not spill over into the real economy.

Another argument is that the Bank of Japan is doing this (expanding the money supply) for 20 years and they still have to combat deflation. My opinion is that the situation in Europe and (especially) in the US is different. Although I agree that QE (as it is practiced) is deflationary, at the end of the day the same is true what I wrote last week: The pity of inflation always starts with an expansion of the money supply.

Further, if one compares the growth rates of broad money supply M3 YoY between the Eurozone, Japan and the US, one observes that M3 growth has been slower in Japan than it has been in the US & the Eurozone. Therefore I would warn anyone who expects a Japanese scenario for the US and the Eurozone.

The final chart shows the yearly change in broad money supply M3 (OECD data) of the Eurozone, Japan and the US. M3 growth rates were strongest in the US, followed by the Eurozone and Japan. Especially Europes sovereign debt crisis lead M3 growth diminish during those years.

However, latest price increases may hint that inflation is coming. Maybe it is already here...

Have a great weekend!

Fabian Wintersberger

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity.

Comments

Post a Comment