Inflation: Postponed Is Not Abandoned

Last week we saw new all time highs in stocks: The Dow reached 34,000 pts, the Nasdaq is at 14,000 pts and the S&P 500 reached another new all time high as well. The same is true for European equities, where the Eurostoxx 50 was able to climb to a new all time high on Wednesday. Global equities move in only one direction: Upwards.

The height of liquidity that is going into equities has been highly impressive recently. According to BofA Global Investment Strategy 576 billion dollars have flown into equities in the last 5 months which is more than during the last 12 years combined, where total inflows were 452 billion.

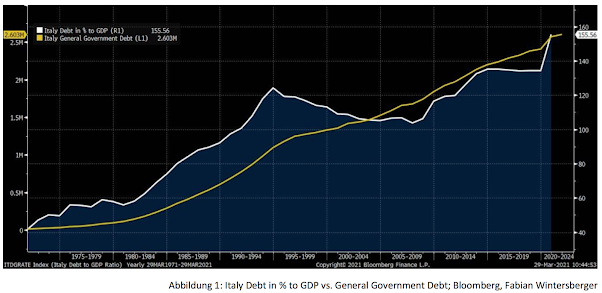

Expansionary monetary and fiscal policy have fueled the global rally in stocks. Global debt/GDP reached an all time high too and is now at 350%. While growth will indeed comeback it is not clear when it will due to the fact that Europe is still mostly in lockdowns and the reopening gets postponed further and further. On Wednesday the German Economic Institute lowered its' GDP projection for 2021 from 4.7 to 3.7%, according to Reuters.

Further I would like to remind everyone that we are still in an economic environment of accelerating inflation and growth. After I wrote about the recent price gains in commodities, the chart of Lumber futures has caught my attention this week. Lumber prices have gone parabolic this year and have nearly tripled this year alone.

Because of those price gains it is not surprising that everyone was excited to see the data of US consumer price gains of March this week. Some may be surprised but prices only rose slightly more than expected, YoY 2.6 % (est. 2.5 %), MoM 0.6 % (est. 0.5 %)

People within the deflationary camp interpreted that numbers in a way that a future surprise in inflation will be pretty unlikely. I have to admit that bond prices, where inflation expectations play a big role, supported this argument because against what one would expect, higher than expected inflation numbers this week did not lead to a further rise in US bond yields. On the contrary, yields slightly went down afterwards.

The reason may be simple: The news that the FDA has paused to vaccinate people with the Johnson & Johnson vaccine after clotting cases. As John Authers wrote (in an again highly recommended opinion piece on Bloomberg) correctly: The data when they arrived weren’t enough to counteract the vaccine news, so the 10-year [US treasury] yield dropped steadily further.

US bond yields have moved sideways recently and some people argue that the reflation trade may be priced in already. Authers continues: In other words, it is positioned for reasonably healthy reflation, but not for a major regime shift toward inflation. Inflation breakevens have barely moved:

However, the NFIB Small Business Higher Prices Index shows that many small businesses are planing to rise prices, although, as Steve Blitz from TS Lombard argues, this may be caused because those businesses also expect a drop in revenues.

While Blitz thinks that these numbers show that there is no sign for cost-push inflation, I disagree. Producer prices rose significantly higher than consumer prices and therefore I think that we can expect higher inflation numbers in the following months. My inflation outlook stays the same.

Nordea's Global Chief Strategist Andreas Steno Larson is seeing it in a similar way and twittered recently: Yesterdays inflation surprise in the US was likely the first of several! 2.75% core inflation in June/July?.

And I wrote about this in the past week a few times: Although unemployment is still higher than it was at the worst point in the 2008 GFC, small businesses struggle to find workers. If business offer higher wages it will lead to a rise in input costs. I am not convinced that inflationary pressures will diminish in the coming months.

There are more signs that business are witnessing a labor-shortage: According to an article in the Wallstreet Journal Uber and Lyft experience record monthly bookings but struggle to find enough drivers. My guess would be that the Biden stimulus checks are a main reason for that because it creates an incentive to stay away from the job market.

An article on ZeroHedge is also talking about the strange situation that there is a labor-shortage in times of high unemployment. I want to quote the following anecdotes:

Early in the Covid-19 pandemic, Melissa Anderson laid off all three full-time employees of her jewelry-making company, Silver Chest Creations in Burkesville, Ky. She tried to rehire one of them in September and another in January as business recovered, but they refused to come back, she says. “They’re not looking for work.”Sierra Pacific Industries, which manufactures doors, windows, and millwork, is so desperate to fill openings that it’s offering hiring bonuses of up to $1,500 at its factories in California, Washington, and Wisconsin. In rural Northern California, the Red Bluff Job Training Center is trying to lure young people with extra-large pizzas in the hope that some who stop by can be persuaded to fill out a job application. “We’re trying to get inside their head and help them find employment. Businesses would be so eager to train them,” says Kathy Garcia, the business services and marketing manager. “There are absolutely no job seekers.

Such occurrences support my scenario that inflation will accelerate within the coming months and I think that many Analysts, economists and central bankers are underestimating this.

With reference to Europe, this situation will be postponed for a while because of all the lockdown policies on the continent but as the reopening occurs, my prognosis will be that we also see a rise in inflation here.

Investors expect higher inflation as inflation expectations are at all time highs.

The coming months will show who is right: Those who expect diminishing inflationary pressures or those who expect accelerating inflation. Although the latest consolidation in bond yields may be something that people in the deflationary camp will point to support their argument that the reflation-trade is priced in.

I think otherwise and continue to expect that 10y US treasury yields may rise to 2.25 - 2.5 % and it should not surprise anyone. I agree with Robin Brooks, Chief Economist of the Institute of International Finance, who twittered the following this week: Many say the bond market sell-off is over and 10-year yield has normalized. HELL NO! The current 1.6% level is where we were in H2 2019 when weak manufacturing data caused a recession scare & the yield curve inverted. We'll have normalized at 2.5%, i.e. pre 2019 recession scare!

Have a great weekend everyone!

Fabian Wintersberger

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity.

Comments

Post a Comment