This Is Not The Top

With the reopening of the national economies, the resulting economic expansion can still create the feeling of pseudo prosperity. Over time, however, the air is likely to become thinner in both the financial markets and the real economy. However, it will take some time until then.

From this point today's commentary starts, because the rally in equity markets has continued since my statement. After moving sideways for month, the Dow Jones has risen to new all time highs and recently passed 33,000 points.

European equities have performed strongly this year as well. While the Eurostoxx 50 is near 4,000 pts and thus in striking distance of another new all time high, the German DAX has also passed the important hurdle of 15,000 pts.

The same is true for Asian equity markets. For example the Japanese Nikkei 225 is on its' highest level since 1990 and therefor clearly left behind the 20+ year bear market as many Japanese equity firms used the low interest environment to consolidate and reduced their corporate debt to equity ratio.

A huge role in this reflationary trend lies in the reopening of many advanced economies, especially because of the reopening within the US which is an important importer of Asian and European goods. If US demand goes up, firms in Europe and Asia are one of the beneficiaries. Value-stocks are the driving force behind the rise in equity markets.

Tech stocks have not been able to profit from the recent rally. The current environment is difficult for many of those growth stocks because we are in a reflationary phase which means that there is accelerating growth and inflation. Central banks around the globe have provided massive amounts of liquidity since the pandemic stared and now that the economies are reopening, this pushes growth upwards.

Simultaneously rates are also on their way up globally. In the US the yield for 10y treasury bonds has been up 70 % since the beginning of the year because many market participants are expecting a short-term rise in inflation.

This hurts growth stocks because their high valuations are due to future expected earnings and a rise in long term rates is diminishing the present value of those returns (I have written about this for quite a while now). The Nasdaq Composite has failed to get back to its' February all time high and currently is back below 14,000 pts.

Commodities are another winner of the current environment of accelerating growth and inflation. copper future prices have nearly doubled since the lows in August of last year (14 % year to date). Oil is also up 30 % year to date, aluminum is up 14 % this year and iron is up 13 %.

While all those asset classes have benefited from the current environment, precious metals are taking a hit. Gold is clearly down of its' August 2020 highs and well below 2,000 US-dollar, currently around 1,750 dollars.

A high risk appetite among market participants can be seen in the corporate bond market, especially investors who bought last year. For example, the cruise company Carnival Corporation has issued bonds worth 4 billion dollars at a 11.5 % yield which is now back below 4 %. (Source: FT). Although rising rates could well mean that there is also trouble ahead.

Market sentiment seems to be very positive as the ISM purchasing manager index and the ISM service survey shows. However, as Bloomberg's John Authers notes, not all is well as businesses are already experiencing inflation because their input costs are on the rise.

Authers goes on:

'Among manufacturers, those with rising costs exceeded those where they are declining by 70%; for services, the figure is 50%. We always knew there would be an inflation scare in the early part of this year, as the cratering of activity 12 months ago drops out of annual comparisons; these numbers suggest that such fears are rational, even if we cannot yet tell whether they have come true'

According to the current narrative a logical consequence of strong growth which lead to a rise in yields and equity prices in the current months and I think that this development will go on further. Although the rise in US treasury yields has paused for now because US treasuries have become attractive for foreign investors who hedge their FX risk.

Further the market seems to be confident that the Fed will fight an overheating of inflation. Many economists and analysts suspect that rising inflation will be transitory. If the Fed is forced to step in, it will be able to do that because the economy is robust, according to their view.

Meanwhile markets expect a much faster normalization in interest rates than the Fed members, if we look at Eurodollar futures. Jay Powell has not missed to point on on every occasion that the Fed will not raise the Fed Funds Rate before 2023. However, according to current Eurodollar future pricings the markets expects 4 rate hikes until the end of 2023.

For me this scenario seems completely unrealistic because I see no economic actor who can bear such an increase in interest rates, neither the state, nor businesses or households. They are heavily dependent on cheap credit for years.

Another factor why equity prices have risen this much is the ongoing stimulus by the US government, where one round follows another with no end in sight. Further the US economy does not seem that robust as many claim because those stimulus checks have another effect apart from pushing up US growth rates.

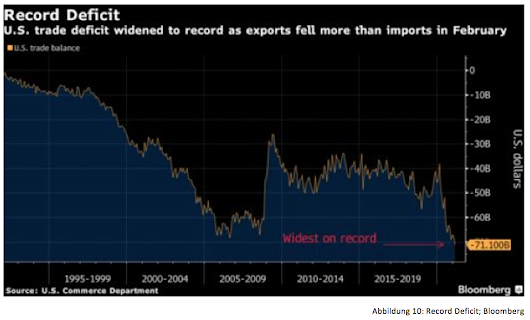

The US economy is largely a service sector economy where most businesses have to import goods from foreign businesses at first and therefore a part of those stimulus money flows out of the country. This is supported by the latest current account deficit of the US which widened to a record of 71.1 billion in February.

It will be very interesting how all the short term inflation expectations develop further, which leads me to another side effect of never ending stimulus: Not only commodity prices rise but wages may follow soon.

If fiscal stimulus remains permanent, many Americans do not have an incentive to return to their low paying jobs although those companies may be in need for workers as demand returns because of the reopening. Maybe they will be forced to raise wages (or go out of business) which will put more pressure on inflation. I will not be surprised if inflation remains at around 2.5 - 3 % after the summer and I am very excited to see how the bond market would respond to that.

Now I want to put the global economic recovery into perspective and therefore want to share a post from Daniel Lacalle with you:

Lots of misleading comments about "IMF growth projections".

1) A bounce is not growth. Most #IMF upgrades still below 2019 level.

2) Most GDP upgrades come from higher gov spending and higher debt.

3) Job recovery in advanced and EM much slower than gdp upgrades would suggest. pic.twitter.com/qmKPPPzgZ6— Daniel Lacalle (@dlacalle_IA) April 6, 2021

The US leads Europe for a few months (because of the European vaccine disaster and the delayed reopening) although also Europe is facing accelerating inflation rates. I think that global demand will continue to increase in the near future and therefore also will be a tailwind for equity prices.

Some economists criticise that the EU governments have not done enough fiscal stimulus compared to the US and demand a stronger stimulus package from the governments within the euro area to boost the economic recovery. However, I want to bring in an argument from Arend Kapteyn, global head of economics and strategy research at UBS, who wrote that the bottom line is that the U.S. has a positive fiscal impulse of 0.5% of gross domestic product this year, while the euro zone has twice as much.

Expansive monetary policy and higher government expenditures have boosted growth and led to a rise in equity and commodity prices. This trend will continue because of the reopening and will further put pressure on inflation. Many analysts expect that the Fed will be confronted this fall and may be forced to think about tapering to fight inflation. Others think that inflation will be transitory and deflationary forces will play a more dominant role then.

If this will happen, then this would support the point the MMTers make who want even more fiscal expansion. The Fed may also react with more of the same and make its' monetary policy even more expansionary. If inflation is not transitory and my case comes true, I suspect that the Fed has a much bigger problem as no one can afford higher rates. Until then, investors will be comfortable with investing in value stocks and commodities. Of course stocks are expensive at the moment but this is not the top.

Have a great weekend!

Fabian Wintersberger

Fabian Wintersberger

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity.

Comments

Post a Comment