Moar Of The Same

After last weeks' ECB rate decision it was time for another FOMC-meeting this week. Although both press conferences did not contain much new information, some statements caught my attention and I want to write about these in the following before I want to discuss the results of those central bank policies and their impact on financial markets, the economy and society as a whole.

So, let us start with the ECB press conference and Christine Lagarde. As expected, no mentions from Lagarde when the Pandemic Emergency Purchase Programs will end, although there may be some signs that the economic situation has improved a little. According to Lagarde, nobody in the governing council is thinking about ending the ECBs stimulus measures because it would be 'premature'.

Although the ECB sounded optimistic: 'The progress with vaccination campaigns, which should allow for a gradual relaxation of containment measures, should pave the way for a firm rebound in economic activity in the course of 2021,' Lagarde said.

It should become a classical Lagarde press conference. Sometimes I ask myself if it may be better to let Isabel Schnabel do it. While she may say very much the same as Lagarde, she definitely knows a whole lot more of what she is talking about. Lagarde always sounds like a robot who gives memorized answers.

Surprisingly she was asked about her opinion on Annalena Baerbock, the green candidate to become German chancellor. Lagarde said that she welcomed the nomination because Baerbock is a young woman with talent and a focus on saving the climate and the environment. 'It does not always have to be old, grey-haired people' , Lagarde said.

I cannot recall that any other president of a central bank has ever endorsed a candidate for a political position. Furthermore it would be against a central banks' principle of neutrality. Central banks should not talk about politics although there is a tendency that central banks want to engage in politics, for example when it comes to saving the climate or fighting a wage-gap between various groups of society. Maybe this is common sense among central bankers already.

However, it was not the only statement from Lagarde that was astonishing: One Journalist asked Lagarde if she understands that some people may be upset about negative interest rates. Honestly, I was stunned by her answer.

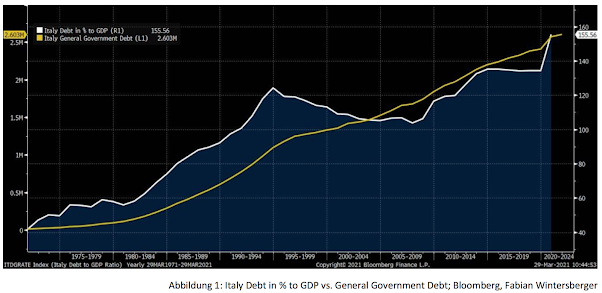

According to Lagarde negative interest rates are an effective tool of monetary policy and the ECB has clear evidence that they are working. I would question this claim because we have implemented negative interest rates for about seven years now. Draghi once sold them as temporary, extraordinary measure to overcome the sovereign debt crisis. Even before the pandemic hit there was not much sign of improvement apart from financial markets.

Largard continued: 'Now, in the whole of the euro area negative rates are passed on to corporates, to a large extent. Not all banks do that, but many banks do that in the euro area. As far as households are concerned, it's 5% of deposit accounts of households that are imposed negative rate consequences by banks'.

Basically she is saying that negative rates do not affect much private households anyway (although more and more banks start to pass negative rates to their customers). However, Madame Lagarde added that she understands that savers are upset that the do not receive interest on their savings, but the ECB has to see the whole picture and cannot take everything into account.

Further she claimed that negative interest rates are benefitting young households because they can borrow money cheap to buy housing or other goods. This claim is pure framing, because the ECBs negative interest rate policy has induced a flight into hard assets. For example german house prices have exploded after the ECB implemented negative interest rates.

The ECB achieves that a young couple can borrow cheap to buy overvalued housing. Latest data from the United States shows that less young households live in their own home, comparing to elder generations at the same age. I would suspect that the situation is alike in Europe (if you know otherwise, feel free to contact me).

'The contribution that that is, in order to support the economy, in order to make sure that jobs are kept, in order to make sure that corporates can continue to operate and produce, is clearly a trade-off against some aspects that are resented by those that are only savers, and are not borrowers.' Lagarde continues. This is totally in line with another statement from last november where she said that we will be happier to have a job rather than protected savings. Make your own conclusion!

Astonishing statement!

— Fabian Wintersberger (@f_wintersberger) November 19, 2020

"I think we will be happier to have a job rather than having protected savings." - Christine Lagarde

Without savings, one has to work forever & has no chance to pursue happiness. They'll inflate your savings away.

Got some non-inflatable assets? https://t.co/PwGoLuso52

Now, enough about the ECB, let us look at the FOMC meeting from this week (Transcript). The Fed, again, said that there are signs of an economic recovery although it is to soon to think about a change in monetary policy because the labor market is still vulnerable and far away from full-employment. Signs of inflations are observable, but according to Powell these are mere base effects.

Lots of journalists asked Powell about inflation and he showed that this got a little bit on his nerves. We have to see inflation sustainable above 2 %, Powell said and he continued that he wants to see inflation expectations higher as they are currently. Only a strong labor market can achieve this, Powell said.

Chris Rugaber (from AP) asked if companies are struggling to find workers because there is still a lot of fear with reference to the virus and problems to organize child care. Powell agreed. In fact, whenever he was asked about inflation, Powell switched and talked about problems on the labor market. The labor market is Powells number one argument to justify why the Fed is not thinking about thinking about thinking about tapering.

What Powell is totally ignoring is that lots of companies struggle to find workers, although he talked about that there is still fear to get sick. I am not so sure about that this is the main reason that people do not return to work (although it may play a role for some people). My guess would be that it is the Biden-Stimulus checks and extra unemployment benefits that keeps them away from returning into the workforce. Like Andreas Steno Larsen from Nordea, I am not convinced that the Fed is anticipating this correctly.

Central bankers are so convinced that inflation will not return because it has not after the GFC, but there is a huge difference today: Strong growth of broad money M2 because of fiscal transfer payments could very well cause inflationary pressures. The second effect of transfer payments is (as mentioned above) that people may not plan to go back to work as soon as possible.

I am still astonished that neither Lagarde nor Powell are acknowledging that there are side effects of extraordinary monetary policy. Powell was asked on Wednesday if monetary policy is driving asset prices and his answer was that, of course, some equity prices are frothy, but not the whole market.

What is more concerning in my opinion is, that low/zero/negative interest rate policy is driving more and more investors into risky assets. Two examples: CCC bond spreads are at historic low levels and super high leverage. Powell: Leverage is not a problem.

Apple announced stock buybacks of 90 billion this week. I am sure it will help that the Fed has also bought Apple bonds to fight the crisis. In sum it is expected that stock buybacks will return back to pre-crisis levels and cause a jump of 30 % compared to last year.

Maybe this sounds strange, but in my opinion the best strategy still is to be long in equities. The rally is likely to continue until summer at least and it is to soon to minimize risk. Also, an increase in US yields is not over and will continue.

However, the macroeconomic price for this everything rally is very high: We have similar growth rates than in the 1980s but we spend a multiple of fiscal stimulus as we did back then.

The press conferences by the ECB and the Fed showed what has been expected already: Current monetary policy will continue for longer. However, it is astonishing to me that both are dismissing the arising problems and consequences for society.

What we got was moar of the same. As long as market participants believe that central banks will be able to keep things under control, extraordinary monetary policy can continue. When it comes to corona, everybody is talking about a new normal, while in monetary policy terms, the new normal has been implemented more than 10 years ago...

Have a great weekend!

Fabian Wintersberger

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity.

Comments

Post a Comment