A Game of Thrones

Everyone who has watched the TV series 'Game of Thrones' is fascinated by all protagonists' continuous change in alliances. Long-term fellows are betrayed from one moment to another just because the protagonists hope for a better position to gain influence and, therefore, power.

The show is engaging because George R.R. Martin is also looking at those who pull the strings behind Westeros' mighty kings and queens. Finally, these people decide who will reign over the Seven Kingdoms of Westeros.

My favorite protagonist was Varys. His wide net of spies informed him about everything that was going on in the Seven Kingdoms. Therefore, by manipulating communication, he guided the people on the top that he considered the best direction. Although he claimed that all his actions are done because of the greater good, everyone understands (at least at some point) that, in the end, he is only interested in his own destiny.

Maybe the game of politics in our western world is comparable but obviously much less brutal. In a sense, every participant is carefully deciding future actions to gain an advantage. This brings me back to all the events concerning the Federal Reserve...

We know that Jay Powell is considered the old and future Fed-Chair, at least by Joe Biden and Janet Yellen. However, Powell has a problem: Although the Biden-Administration puts trust in him, the left-liberal arm of the democratic party is deeply mistrusting him.

Those people officially stated that they wanted another Fed-Chairman after Powell's term ends for a while now. At the end of August, the media highlighted a statement from some house of representatives members, including Alexandra Ocasio Cortez, the star of the democratic left.

According to the statement, the initiators accuse Powell of doing too little to fight climate change, racial injustice, or economic inequality. Let's have a brief look:

'As news of the possible reappointment of Federal Reserve Chair Je-rome Powell circulates, we urge President Biden to re-imagine a Federal Reserve focused on eliminating climate risk and advancing racial and economic justice. This consequential appointment has the potential to remake the composition of the Board of Governors. While the Federal Reserve has made positive changes to its ap-proach to full employment reflected in the new monetary policy framework, our concerns with Chair Powell’s track record are two-fold. Under his leadership the Federal Reserve has taken very little action to mitigate the risk climate change poses to our financial system....

... Secondly, under Chair Powell the Federal Reserve has substantially weakened many of the reforms enacted in the wake of the Great Recession regulating the largest banks... To move forward with a whole of government approach that eliminates climate risk while making our financial system safer, we need a Chair who is committed to these objectives'

Or differently: Those people think that Powell's monetary policy should have been even more expansive. They want more Fed interfering into the free market process and easier access to free money to spend it on all the things that - according to them - will lead to a golden future.

Totally coincidentally, the last few weeks have put some interesting facts into the light of day. Things would have been impossible for someone who works in a private financial institution, but it does not seem to matter if you work for a public institution. It is even more astonishing than the German Wirecard scandal, where members of the Federal Financial Supervisory Authority BaFin had traded the stock while investigating it.

It is about people on the top at the Fed: Jerome Powell and other Fed governors are affected, especially Eric Rosengreen (Boston Fed) and Robert Kaplan (Dallas Fed). Do you remember the Powell Put from March 2020? The Fed put all chips on the table to save financial markets from collapsing by buying all sorts of assets: treasuries, corporate bonds, mortgage-backed securities.

Interestingly, the Fed bought assets that those guys had in their private accounts as well. Powell owned millions in muni-bonds, Rosengreen was highly engaged in trading Real Estate Investment Trusts. Kaplan even traded S&P futures back and forth so many times that he did not put a specific date into his filing, but only 'multiple'. So, while the Fed was buying all these bonds to save the market, those guys had the Chuzpe to actively trade their own decisions. What is this, if not frontrunning?

If there is one good thing about Elizabeth Warren, it is that she has called those people out: I rise today to express concern about a culture of corruption among top officials [at] the Federal Reserve,” Warren said from the floor of the US Senate. “Officials at the Federal Reserve are entrusted to make decisions that affect the global economy and touch the lives of every person in our country.

However, Warren is not telling the whole story. According to a Wall Street Journal article, the problem lies deeper: More than 130 federal judges broke the law, hearing hundreds of cases involving companies in which they had financial interests. Many could now be reopened. Additionally, Warren is not talking about several exciting trades that Nancy Pelosi's husband has made over the years. So, when in doubt, pick the same stocks that lawmakers are buying?

Maybe, just maybe, there is something else to the story, like George Gammon recently speculated about. Could it be that the recent revelations are about installing a liberal Fed-Chair? This would be a massive step to implementing a central bank digital currency (CBDC), or, as Doomberg called it, Dystopia Coin.

The next few weeks will be interesting. By all mistakes that Jay Powell has made (and I think he made a lot), he is still the biggest hope any hard-money guy can have (and this is another unfortunate fact) because the alternatives would be even more expansionary policies. Or as my wife's grand-aunt uses to say: Something better rarely follows...

A Fed-Coin would mean one thing: more inflation. At least, I do not see a valid scenario where the US government will not use this instrument. Maybe there is hope that some regional bank directors will speak up against that. But about that another time...

The truth is that many central bankers are now talking that inflation may not be transitory, and according to Luke Gromen, 'it will better not be' for the US government.

As we all know, there are only two possibilities for highly indebted countries: Declare bankruptcy or inflate the debt away, step by step. History shows that governments prefer the second. How could that be achieved? Yes, Yield Curve Control.

The last time the Fed has implemented yield curve control was from 1940 until right before the United States entered the Korean War. Inflation was higher than yields were, so real yields were negative. This way, the US could finance its large deficits at the expense of the bondholders.

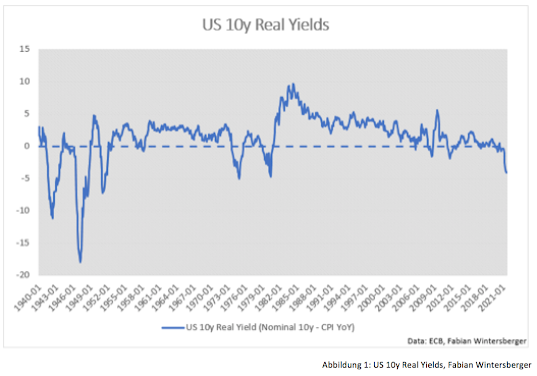

If we look at this chart, we realize that real yields have only been negative for longer in the 1940s and 1970s. In the 1940s, they have been deeply into negative territory because of high inflation, capital controls, and (mostly) goods rationings. Real yields also fell at the beginning of the 1950s, but only for one year.

As the US entered the Korean War, many citizens and businesses expected price controls to be re-implemented and therefore raised prices. But prices fell shortly after, as this was not the case, and real yields turned positive again.

In the 1970s, commodity prices went through turbulence, especially oil. The result was high inflation rates, fueled by monetary expansion in the 1960s (Great Society program). However, the Fed was fearful and did not want to cause a crisis in the job market.

Central banks took Philips' model for granted back in the days, that higher inflation meant less unemployment. The Stagflation of the 1970s showed that there could be decelerating growth and inflation simultaneously. It needed Paul Volcker, who followed Arthur Burns, to end the inflation by raising interest rates heavily.

Nowadays, real rates are negative again. Although I preferred calculating the real yield by subtracting breakeven yields with nominal 10y yields, I chose not to because historical data (at least the one I found) is calculated as follows: nominal yields minus YoY inflation.

As one can see, real yields went down in the second half of 2019 already. In my opinion, because the Fed kept its monetary policy too loose for too long. It should have raised rates sooner, and it should have started sooner to shrank its balance sheet.

Nevertheless, the paradigm shift took place even before Trump, under Obama. Obama and Trump have brought Debt/GDP levels back to WWII levels. The Trump-reign has led to an artificial boom fueled by easy money and tax cuts, but it also caused a further surge of debt. As many indicators may lead to the conclusion that inflation will remain higher than before the pandemic and growth will remain slow, at some point, the Fed will have to act.

There seems to be only one way out, namely negative real rates. This way, the federal government can bring the debt down to a more sustainable level, raise rates again, and start the leverage game again...

If foreign investors do not want to buy US treasuries, only one buyer is left, the Fed. And who would be more willing to be part of such a game: Jay Powell or a new, more progressive Fed-Chair? I let you decide...

Will this lead to a scenario be similar to the one after the war? I am not sure: The US is now the biggest debtor nation, import champion of the world, and most production takes place outside of the US nowadays. Further, inflation rates will not be that high as after the war, at least in my opinion. However, most will depend on future reactions of the Fed.

The big question for investors? What assets are performing in such an environment. As equity markets are struggling to go higher, maybe there is not so much upside left? Especially if the Fed really announces tapering at its November meeting. Many stock companies have profited from the Fed's PPP.

You see that in the 1940s and 1970s, stocks only rose slightly and mostly traded sideways. Gains were way below inflation. Compared to commodities and gold, they were a wrong choice in the 1970s. Probably it is not wrong to consider investing in them. But, keep in mind that past performance is no guarantee of future gains...(and definitely do not consider this as investment advice!)

It can be different this time, and maybe it is. Gold is not moving much despite negative real yields. I would suspect they will become even more negative in the future, especially if a new, progressive Fed-Chair is replacing Jay Powell. Until then, the game of thrones continues...

Have a great weekend!

Have a great weekend!

Fabian Wintersberger

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity.

Comments

Post a Comment