Winter Is Coming!

Everyone looked at the German elections last Sunday. It also marked the end of an era: While modern time is separated between before and after Christ, the German political landscape in the 21st Century can be separated into before and after Angela Merkel.

I do not know if you remember September 18th of 2005, which marked the beginning of the Merkel Era. After being in lead by a wide margin in all national polls, election day has been a disaster for CDU/CSU. It only slightly came in at first, only one percentage point ahead of the governing social democrats. It was the second-worst result for the conservative party in history.

Gerhard Schroeder, leader of the social democratic party and chancellor back then gained hope for another, third period as chancellor of the Federal Republic of Germany. As always, political leaders came together on national television to discuss the election results.

The rest was history: Schroeder was aggressive during the debate, claiming that he and his party were the ones who would form a new government. It was very disturbing to watch, as I can remember, and one could assume that he was drunk. However, back-then host of the debate, ZDFs Nikolaus Brender wrote in an article in Cicero in 2017:

"Hartmann von der Tann [host, ARD] and myself did not have the impression that alcohol was the cause why Schroeder has turned into a war elephant that evening. It was his ego that stimulated him and caused his attacks against Merkel, against us and against reality"

While Schroeder risked his neck with careless talk, Merkel was unable to react properly as she was shocked as well because of her party's bad result. However, she did not have to as Schroeder dismantled himself.

Back then, nobody thought that the Merkel Era would last for 16 years. Strangely enough, she profited big time from Schroeder's Hartz-Reforms, while those reforms were one of the major causes of his political ending.

Compared to Schroeder's ending, Merkel's bid farewell was much calmer. She chose her successor, Armin Laschet, who was considered loyal to her.

During her reign, CDU/CSU was very flexible about political standpoints. Merkel's opinion was highly influenced by public opinion, the best example is her standpoint on nuclear energy. Under her watch, CDU/CSU became a lighter version of the social democratic party (another reason why the right-wing AfD came into existence) and hence it was nearly impossible for Laschet to gain a foot in the election race. This was perfect for the (as we now know) winner of the election: Olaf Scholz, ironically SPD general secretary under Gerhard Schroeder.

However, it is not a done deal that Scholz will become Germany's next chancellor. It will be up to the Greens and the liberal FDP party to decide who will be the next chancellor, whether Scholz or someone from CDU/CSU. Both parties already decided to speak to each other before talking to SPD or CDU/CSU. A brilliant move, in my opinion. Whoever will make the most concessions will be chancellor...

A leftist government is out of any possibility, and financial markets were happy about that. The German DAX closed in the green on Monday.

Nevertheless, Tuesday was different, although it had nothing to do with the German election outcome. However, it showed one of the major challenges that a future german coalition might face: rising energy prices.

On Tuesday, oil prices reached a new three-year high.

Additionally to rising oil prices, natural gas prices continued to spike, causing further worries apart from concerns that the Delta-variant may hamper the recovery.

While everyone talked about gasoline shortages in the UK last weeks, the latest developments let me conclude that it is not only the UK but the whole world which may face an energy problem. European natural gas prices currently are three times above their long year average.

From the Financial Times: European benchmark gas prices for delivery next month climbed another 10 per cent, meaning that costs have doubled since the middle of August, while the price of offsetting carbon emissions — through contracts known as offsets — continued to rise, pushing further past €65 a tonne in intraday trading on Tuesday.

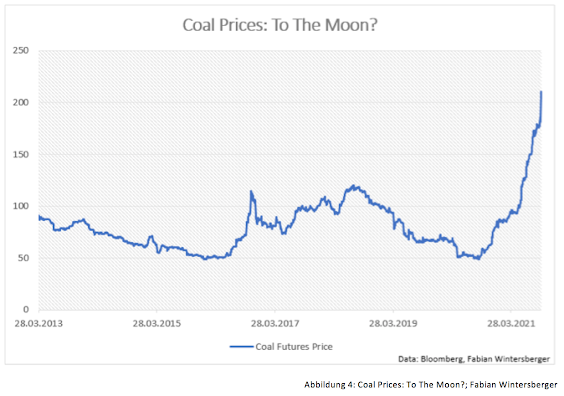

Possibly the problem could become a global issue. Not only did higher demand for natural gas (especially from Europe and China) as an alternative to dirty coal caused prices to rise, so did Russia's decision to scale back on supply to other countries. Russia faced a harsh winter last year and therefore wants to fill in its own storage before supplying more to others. But it is not only gas prices, coal prices have doubled recently:

China, which is heavily dependent on coal, is already experiencing problems with energy supply and thus many of its provinces allegedly have had energy shutdowns already.

From Reuters: News organizations and social media carried reports and posts saying the lack of power in the northeast had shut down traffic lights, residential elevators, and 3G mobile phone coverage as well as triggering factory shutdowns.

The EU's plan to transform the economy into a green economy is exacerbating the problem further. Especially, if it abandons nuclear energy as Germany did. There is a reason why German energy prices are around the highest within the European Union.

Investors are worried and as a result, global equity markets struggled this week. Although, even if you can hear all the bears bragging about that this will be the start of a much more severe decline, I am not so sure, personally. A 2 % downturn is not a crash, even if one assumes that stocks only go up.

Bad news for businesses, as rising commodity and energy prices are driving up production costs. The Fed's plan to normalize its monetary policy by scaling back on its asset purchase programs is another nail in the coffin. Since the last FOMC-meeting, 10y treasury yields rose by 20bps.

Uncertain times ahead indeed, and therefore higher demand for the dollar:

And, if that wasn't enough, investors are worried about the US debt ceiling, which will be reached in the mid of October, according to Janet Yellen. But why worry? Democrats have enough seats in both chambers to vote for a raise of the debt ceiling and therefore I expect that there is no scenario where this is not going to happen. The only reason why they have not done so already is that they hope to get the Republicans on board to have better chances at the soon-to-come mid-term elections.

Normalizing monetary policy is also considered by other central banks (no, no, no! Definitely not the ECB!). The Bank of England is also expected to act soon, but different than the Fed. The BOE's plan is to raise rates first if inflation hit's 4 %. According to their latest forecast, that may be soon:

This brings me back to Germany. It will be interesting to see on which topics Greens and the FDP can find common ground, as both parties stand for the opposite on many topics: For example, the FDP refuses any tax-raises while the Greens are in favor of it to finance the Green Transition.

Although, the claim that the German election was a Schicksalswahl (choice of fate) was strongly exaggerated. CO2 is a global problem and, therefore, can only be solved globally, although the US and Europe can also improve. The CO2 problem is solved on the Asian continent:

I suspect that only a smaller part of the rise in annual CO2 emissions of China and India was caused by transferring production facilities to those countries. The much bigger part must be from higher demand for energy consumption because of a rising standard of living of the population in those countries. If China and India will speed up on their Green Transitioning only if Germany leads with a good example? I have serious doubts...

Additionally, Germany has a lot of problems to solve further. The notion that the German economy is a success story only holds at first sight. If you dig deeper, a lot of problems appear, for example, that a big proportion of job growth since 2008 has been in the part-time sector:

People may argue that the recent devaluation of the Euro against the dollar is helping the German export industry (while they forget that Germany once was an export champion with a hard currency). But most production goods need to be imported at first to produce those goods that then can be exported. A weaker currency, supply-chain disruptions, and rising energy- and commodity prices lead to the biggest increase in import prices since the early 1980s:

Rising prices and decelerating economic growth is a very bad combination for an economy. Is this already the beginning of the Great Stagflation of which I wrote about back in June? Did not the 1970s stagflationary period also start with a spike in energy prices?

Back then, rate hikes and deregulation were needed to get the world economy out of this mess. But those are things that seem very unlikely to happen within the current economic environment. Maybe it is not only going to be a long winter for habitants of colder Regions in the northern hemisphere, but also a long, long winter for the world economy...

Have a great weekend!

Fabian Wintersberger

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity.

Comments

Post a Comment