A Roman Fate?

The Empire of Ancient Rome is always an excellent way to start whenever you want to find out something about similarities between Empires. This is true for the rise of Spain, followed by the height of the British Empire, the current world leader, the US, and especially the European Union.

In my opinion, one can find some interesting parallels between those two and, given that they happen at the same ground, just at another time, it makes it even more interesting to look at it. Ancient Rome was reigning over Europe; it was the political center of the world. The European Union is a merger of several national states; Brussels is the political center (although most policies are made in Berlin, Paris, or Rome).

However, there is a difference: While the destiny of Ancient Rome is already in the books, the destiny of the EU is still open. As Mark Twain once said: History doesn't repeat itself, but it rhymes. That is the way we should compare those two eras.

Of course, I know that plenty of factors within the EU are not comparable to Ancient Rome, and listing them may be longer than the supposed length of this commentary. But upcoming economic problems for the EU may look similar to the Roman Empire's economic issues, and while Rome failed to overcome those problems back then, maybe the EU can today.

By 27 BC, when Augustus became Emperor of Rome, Roman legions had conquered various parts of Europe, Asia, and Africa already. However, while within the Empire, Augustus was promoting peace and economic freedom. Free trade, Property rights, and private enterprise were things that he was very open to.

Although some parts of the Empire remained not as free: Especially Egypt, the central resource for grain for the whole Empire was organized socialistic, in an economic sense. Social benefits in the form of free grain, later bread, were only available for approx. 200,000 male Roman citizens, and thus, a free market existed and took care of all the other citizens.

Over time, subsidies got enlarged from grain to oil, to pork, and, to wine and more and more big cities within the Empire implemented such social programs. However, all those benefits needed to be financed. Therefore, the Empire raised taxes, mainly wealth taxes. The provinces were required to pay Rome what they had collected from their citizens.

However, most governors of the provinces were mainly interested in making their own legacy and therefore loaded up on debt. Debt, which they borrowed from the tax collectors. Augustus ended this when he implemented a 1 % wealth tax and a per capita tax. As the amount of taxes to pay was known in advance, this encouraged overproduction because everyone could keep the whole fruit of his own labor that he produced more.

A big part of increasing wealth in Ancient Rome was free trade: Commerce, especially foreign and inter-provincial maritime commerce, provided the main sources of wealth in the Roman Empire (Rostovtzev, 1957).

Over time, the money supply grew substantially, but not faster than the number of goods, and thus there was hardly any inflation. But, under the reign of Augustus, interest rates fell to an all-time low. As a result, Augustus implemented massive workers programs and expanded spending. His successor, Tiberius, cut those programs and caused a financial crisis due to a money shortage (most money was cash money and very little credit. Therefore, any government surplus meant a contraction of the money supply). Only the government providing liquidity with zero percent interest rates led to a relaxing situation.

Although, after the Roman expansion halted under the reign of Trajan (997*117 AD) and no other sources of income were conquered, additional spending had to be collected in advance via taxation. This marks the beginning of the end of the Roman Empire.

Now, all the problems that were covered up by all the conquering were exposed. After Augustus' death, his successors began to inflate the money supply by weakening the purity levels of coins in circulation.

But contrary to what some may expect, the monetary expansion did not lead to a rise in tax revenues, as people started to hoard old, purer coins and spent the newer, less pure ones (Gresham's Law). While the monetary expansion was successful initially, it soon turned out to be negative as tax receipts went down and the fiscal situation got worse.

Then the Empire started to privatize government land and implement a higher wealth tax where expensive goods were taxed away from the upper class. It went that far that the Empire invented battles that the Roman army allegedly won to raise more taxes.

Additionally, more and more people had to pay taxes while wealth taxes became higher and higher. Interestingly, this was not about raising money solely. It was also about keeping those people away from gaining influence and power.

As the economy continued to slow and the rich could not pay any additional taxes because the government took nearly everything from them, the tax burden reached the middle and lower class. Historian Michael Rostovtzeff wrote: The heavier the pressure of the state on the upper classes, the more intolerable became the condition of the lower.

Coin purity was weakened further, and, as the supply of goods did not grow with it, prices started to puck up. Rostovtzeff estimates that in the 3rd Century, inflation in Rome was at 15,000 % (150 % YoY).

Diocletian tried to fight inflation through price controls, and he failed badly because he did not understand that the money supply led prices to skyrocket. Instead, Diocletian claimed it evil speculators and hoarders are guilty of the rise in prices. As a result, the price controls failed severely, and, as money was worthless actually, the government started to collect tangible assets. A central planning authority started to coordinate all economic activity. To be fair, Diocletian also made some reforms, for example, to distribute tax burdens further or that taxpayers knew in advance what they owed the government. Though, the main problem for the Roman Empire was the high costs for its' army.

When Constantine became Emperor, central planning got intensified. For example, workers were tied directly to their working place now and were not able to leave. Taxes got higher and skyrocketed: Within 50 years after Diocletian, tax rates have doubled and caused the collapse of the most important industry of those times: Farming.

Although successors of Constantine tried to reverse course, it was already too late. Still, no one realized that inflation was caused by the devaluation of currency and blamed speculators for it. Tax reliefs could not change much, and further, they were mainly introduced to the upper class. In the end, the Empire could not withstand the barbarian invasion, and the Empire imploded. But contra wise to that one might expect, although the fall of Rome appears as a cataclysmic event in history for the Bulk of Roman citizens, it had little impact on their way of life.

Bruce Barlett concludes: Higher and higher taxes failed to raise additional revenues because wealthier taxpayers could evade such taxes while the middle class - and its taxpayers were exterminated... Although [it] was an event of great historical importance, for most Romans, it was a relief...

Maybe you have already discovered some events that sound similar to events that happened to the European Union; I want to apologize in advance that I may not mention one or the other. Comparable to the Roman Empire (or not), the EU was founded on free-market principles as the Coal and Steel Community, which later turned into the European Economic Community when the treaty of Rome (funny, is it not?) was signed.

In fact, the EU's predecessor was a free trade zone between its members. The 4 main principles are the free movement of goods, services, capital, and workers.

Then, in 1992, shortly after the iron curtain had fallen, the European Economic Community became the European Union with the treaty of Maastricht. The implementation of the Euro was also a part of the treaty, the price for the German Wiedervereinigung that Chancellor Kohl had to pay.

More and more states joined the EU in the following years because they hoped to benefit from free trade in the form of higher wealth. The EU budget (payments from the member states to the Union) rose and generously got redistributed by EU officials, primarily to new members, to help them gain prosperity. Thus, more eastern European states wanted to join the Eu because they hoped for capital inflows.

In return, the west could buy goods and services from those countries at a lower price. Principally, the EU is a social state, but on a nation-state level. And, who is turning down free money? Yes, Nobody.

Over time the EU turned from an economic union into a political association, or, to be more precise, is in the middle of doing so. While the prime idea was to benefit from free trade and competition, especially France or Italy, or Germany also pushed for a more centralized European Union.

Probably the EU's brightest days were the significant eastern expansion in 2004 and the implementation of the Euro as a currency. At first, everyone profited, and everyone got wealthier. Unemployment rates went down within the whole Union because of an artificial boom fueled by low-interest rates.

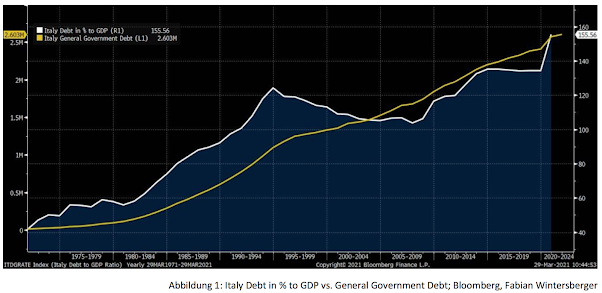

However, we all know what happened. During the GFC in 2008, the economic expansion suddenly stopped, and debt/GDP ratios went up slightly before they exploded during the European debt crisis in 2010. Especially the unemployment rate went back up in the southern hemisphere as a result of it.

Without a doubt, the situation got more complicated after the Euro was introduced. On the one hand, the PIGS states suffered from rising debt, high wages (thus unemployment), and a lack of structural reforms; the German population suffered from low wage growth because of a weak Euro. On the other hand, the PIGS could import more goods and services and not need to produce on their own anymore (they could enjoy the fruits of foreign labor); the German export industry also profited.

I would like to point out that the situation may be comparable to Ancient Rome: Economic imbalances could be covered up by conquering in Rome. Around 2,000 years later, in the EU, new members joined freely because they expected free money. If no new member joins, then you need to raise more money from current member states. Because of that, I am not surprised that the EU is in talks about future membership since I am interested in economics and politics.

Although the EU increased payments for member states regularly, the members are not very happy with that option. As long as the number of members increases, the EU Commission can redistribute gains without increasing payments for the member states. However, as there are few countries left in Europe, this option will not be one soon.

Additionally, Brexit was not very welcomed by EU elites, as Britain was one of the biggest net-payers. Thus, I am not surprised that the EU always tries to bully the UK for its decision, even though it disappoints me.

Like in Ancient Rome, the EU needs to raise payments from its member states (or at least from those capable of paying more). Additionally, even though currently disallowed under EU law, the EU could raise capital by selling bonds. Narrowingly speaking, the EU broke the law when it issued Corona bonds, but as all the member states agreed (again: who wants to turn down free money) - who cares? Never waste a good crisis, so they say...

Additional revenue means additional bureaucracy, something that the growing amount of people working for the EU proves. If you think about it, it is just apparent why they want to have more and more power: More power means more administration, means more money, means more power... Thus I expect that the EU Commission is pushing forward to collect EU taxes and soon implement one.

The EU is already using the Global Warming Crisis as an excuse to gain influence and power. At least the goals are very ambitious: The EU wants to become THE climate pioneer, and the brewing energy crisis will not change that.

However, maybe the EU is not totally innocent of high energy prices. For years, Ursula von der Leyen thought that the EU had greater leverage than Russia when it implemented sanctions on Russia to help the opposition gain more power within the country. Now, as the EU needs natural gas from Russia, Putin is enjoying every minute of it.

Furthermore, because global warming is a global crisis, emerging economies like China or India always have the incentive to run their energy on coal or gas because of a lack of alternatives. This strategy may become a disaster. Mainly because the EU wants to go the German way and intends to neglect nuclear power altogether. A big mistake, in my opinion, as it also improves Putins negotiation position.

If we think about future economic growth, the de-industrialization of Europe may continue. Domestic oil and gas exploration and development will be intensified. China is already rethinking the pace of its green transition: Given the predominant place of coal in the country's energy and resource endowment, it is important to optimize the layout for the coal production capacity...Domestic oil and gas exploration and development will be intensified.

Sadly, the worst possible thing happened, and von der Leyen stated that she and the Commission would work on something to fight higher energy prices. I fear that they want to do the same thing Diocletian did: price controls. If you read carefully, you know how that worked out...

Although I have to admit that no one else can push EU-centralization more forward than Ursula von der Leyen: She is a pure marketing machine. Just watch her press conferences: These are feel-good events where she tells all the attendants how wonderful everything works out and how ambitious the Commission is.

While in Ancient Rome, the state-controlled the money supply, it is the ECB in the Euro Area. And, maybe just as it was intended when they made Christine Lagarde head of the ECB, the ECB will be beneficial to push EU centralization forward. At least, that is what I suspect.

The ECB will either keep financial conditions in favor of borrowing or finance specific EU investment projects like the Green Deal. While the Federal Reserve is talking very specifically about tapering its asset purchases, the ECB is thinking about a bond-buying program after PEPP, allegedly to gain more flexibility (I hear Madame Lagarde's voice in my head).

Of all major Central Banks, the ECB still claims that inflation will be transitory and fall to pre-crisis levels soon. Isabel Schnabel recently compared the current spike in inflation rates with a sneeze without long-term consequences. Well, I would say that German wholesale prices disagree. They rose to 13.2% YoY, the highest level since...? Correct, the highest level since the last energy crisis in the 1970s.

Interestingly, there is a difference to Ancient Rome: Rome's most significant budget post was the army, while the EU does not even have an army. Although there has been much talking about border protection lately, the main burden lies on Recep Erdogan and Turkey, who the EU member states pay to do the job.

As I am still a great proponent and fan of the original idea of the European Union, free movement of capital, goods, services, and workers, I really hope that somewhat can stop the centralization. Europe did well in the 19th Century because it consisted of many small states who competed for the best man, the best ideas, and the best form of government. That is what made Europe successful, and it will make the EU successful again (apart from a return to a sane monetary policy). If we do not reverse course, future generations will talk about the same destiny of Ancient Rome and the EU-era.

Have a great weekend!

Fabian Wintersberger

Fabian Wintersberger

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner, and do not represent those of people, institutions, or organizations that the owner may or may not be associated with in professional or personal capacity.

-----------------

Main Source for the Economic Collapse of Ancient Rome: Bruce Bartlett

Comments

Post a Comment