The Great Leap Forward

It was 1958 when Mao Zedong, Chairman of the Chinese Communist Party and Founding Father of the Peoples Republic of China, initiated Chinas Great Leap Forward. Mao's goal was to transform the Chinese economy from an agricultural economy into an industrial economy and make China one of the big global players.

Three-quarters of all Chinese have worked in agriculture back in those days, and an expansion of agricultural production was challenging due to the lack of further cultivation areas. For this reason, the Communist Party wanted to promote industrialization.

Mao took a decentralized approach: The municipalities should push local industrial development forward to produce a) agricultural tools and b) machines. Mao ordered masses of workers to quit their agricultural jobs to shift to working in industrial production.

Especially concerning steel production, Mao's goals were ambitious. Within a couple of years, so was his plan, China should become one of the leading steel producers. Therefore, he ordered that there should be little blast furnaces in every backyard of the country. The way steel was produced there was amazingly primitive.

The awakening was pretty bad. Soon it turned out that much of what was produced (in these backyard furnaces) was not steel but useless iron. Thus, no tools or machines could be built to increase agricultural productivity. Even worse, to produce steel, lots of agrarian working tools were melted, and as a result, agricultural output further diminished.

Mao's Great Leap Forward was a total disaster and led to one of the greatest famines in human history. Millions of Chinese paid for his vision with their lives. The forceful transformation did not bring economic growth and prosperity, but just misery and death, contrary to what Mao had promised.

Why do I write about this? Because economic transformation is in-vogue again. Today, European politicians promise that a green transition of the economy will save the planet and create lots of jobs and prosperity. Ursula von der Leyen, on December 9th, 2019: Therefore, the European Green Deal is, on the one hand, about cutting emissions, but on the other hand, it is about creating jobs and boosting innovation.

Shortly after, the pandemic hit the world, and the reaction of governments and central banks has led to more severe imbalances, which may contribute to the result that the green transition will be Europe's Great Leap Forward. But about that later.

This week another event eventually caused the attention of financial markets: The November FOMC-meeting, where everyone waited for an announcement that the long-awaited tapering was finally going to start. According to Fed-Chair Jerome Powell, beginning with November, the Fed will reduce its purchases by 15 billion US-Dollars per month (10 billion in Treasury bonds, 5 billion in mortgage-backed securities).

Tapering should end in the middle of 2022, but Powell dismissed prospects of a soon rate hike: We don’t think it is a good time to raise interest rates because we want to see the labor market heal further. The unemployment rate is still 1.4 percentage points above pre-crisis levels.

Well, the market seems not to be totally convinced. Eurodollar futures continue to price in a 70 % probability of a rate hike in June 2022.

Although the yield curve steepened a little bit after the press conference, the bigger picture more points to a continuing flattening. The more interesting question is: Does the market think the Fed's tapering/tightening comes too soon or too late?

However, it seems that, in contrast to what I think, market participants (or the majority of them) are confident that inflation will not be persistent. Powell has made very clear that the Fed has all the tools it needs to fight inflation if it gets out of hand and will not hesitate to do so if it has to.

As a result, market expectations about inflation have weakened again: US 5y5y inflation swap rates fell 12bps yesterday and now is closer to the Federal Reserves target of 2 %.

However, not very much happened if we look at real rates, which remain in very negative territory. Neither in the US nor in Germany, I expect that this will change anytime soon.

In the stock market, however, the party is still going on. US stock indices reached record highs repeatedly this week, for example, the S&P 500 and the Dow Jones Industrial Average. Here is a year-to-date performance of the S&P, Dow Jones, the European Eurostoxx 50, the German Dax, the Japanese Nikkei, and the Chinese Hang-Seng. US and Europe lead, while Japan follows and Hong Kong is down on the year. The Chinese economy is in trouble due to the problems in the real estate market on the one hand and to several corona-outbreaks on the other hand.

To end this part: Powell again has claimed that the Fed's reaction was necessary to assure smooth functioning markets, which reminded me of Tuesday's events around Avis Budget Group. Smooth functioning markets, I guess.

But now, back to my main topic of this week. The COP 26 meeting in Glasgow has begun, where the world is negotiating on future climate goals. Europe has argued for several years now that they want to lead by example. Therefore, Ursula von der Leyen (EU Commission President), who is not hesitant to state how important it is to prevent climate change, choose to travel to Glasgow by train instead of chartering a private jet...

Of course, I am just kidding!

Without a doubt, I see the good intentions (which I support), but the implementation seems a little hasty. Further, I doubt whether the people in charge think enough about the consequences of a rapid exit from dirty energy.

Let us check reality: The oil price is back to 2018 highs after it plummeted in 2020. On the one hand, it is because of rising demand (some other factors may also play a role), but on the other hand, it is because of a lack of investing. Companies have not invested in increasing productivity for quite some time now. I guess it is hard to convince a company to invest if you want to ban the product they sell in 10 years.

Reliable energy sources are necessary to produce goods and services. Coal is not an option for Europe (and there are good reasons for that), and natural gas is still not flowing very fast despite what Putin said. I may repeat once again, but maybe someone at the EU should have thought about this before putting sanctions on Russia.

Luckily, there is a tiny minority of European countries that produce nuclear energy. Otherwise, the energy supply may have already become problematic. Not many countries are as lucky as Austria.

Energy is essential to produce goods and services. It is necessary for life generally. Without energy, there is just death.

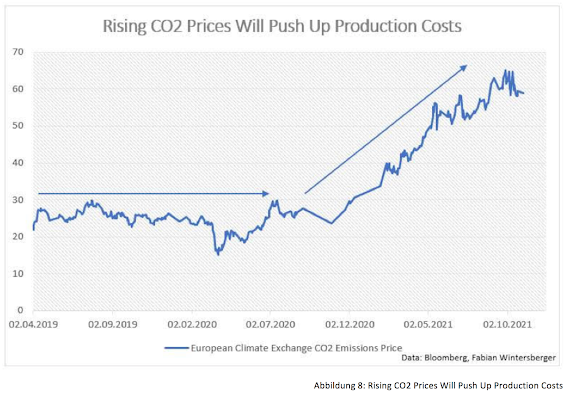

Europe wants to abandon fossil fuels but lacks possible alternatives. Many European countries oppose nuclear energy. The latest implementation of CO2 prices in several EU countries will put further pressure on European producers. If you want to produce in Europe, your costs will probably rise big.

When Europe recently faced an explosion of energy prices, politicians relied on some old school tools: Price controls, which will exacerbate the problem instead of changing it for the better.

Additionally, not enough natural gas supply and high energy prices have another terrible effect on another part of the economy. A segment that affects everyone, no matter if you are rich or poor, young or old: Food.

To produce food or animal feed (to feed the animals that will eventually become food) in amounts Europe needs, one needs fertilizer. Fertilizer is made of phosphate and ammonia. To mine phosphate, one needs fossil fuels, and to produce ammonia, one needs natural gas. If prices for European farmers rise, they have only two possibilities: raising prices or going bankrupt. Prices are already on the rise, but no one wants food prices to skyrocket.

Of course, there are alternatives. For example, to produce enough photovoltaics and pinwheels to cover as much of our energy demand using green energy. However, there is a catch to that: To build those things, you need steel. Steel is produced in furnaces under very high temperatures. How? By the use of coking coal, made of coal. Of course, prices increased for coking coal too recently.

As a result, there are two possibilities: Either one agrees on alternatives to produce the needed steel in Europe (nat gas would be an option) and dismisses the radical net-zero approach or production will go somewhere else, China or India, for example.

Europe needs a real energy strategy. Net-zero sounds nice, but it is just a slogan, not a strategy. And during the transformation, I fear we will have to rely on fossil fuel as an alternative energy source. Otherwise, the Green Transformation has the potential to become Europe's Grand Leap Forward.

Have a great weekend!

Fabian Wintersberger

Disclaimer: This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner, and do not represent those of people, institutions, or organizations that the owner may or may not be associated with within a professional or personal capacity.

Comments

Post a Comment